UniCredit

UniCredit is a pan-European Commercial Bank with a unique service offering in Italy, Germany, Central and Eastern Europe.

They serve over 15 million customers worldwide across four core regions and two product factories - Corporate and Individual Solutions.

Employees: 86,000

Revenue: €18 Billion FY2021

HQ Location: Milan, Italy

What they do:

They provide banking and financial services across Europe.

They have four operating regions

Italy

Germany

Central Europe

Eastern Europe

They have two ‘product factories’

Corporate Solutions - selling to 1m business clients

Individual Solutions - selling to 14 million retail consumers

Their vision and priorities:

Our Purpose:

To unlock the full potential of individuals and business across Europe and to empower communities to progress.

Our Core Values

Integrity - acting in the best interests of our customers

Ownership - accountability for actions and commitments and empowered to make decisions

Caring - caring for customers, communities and each other

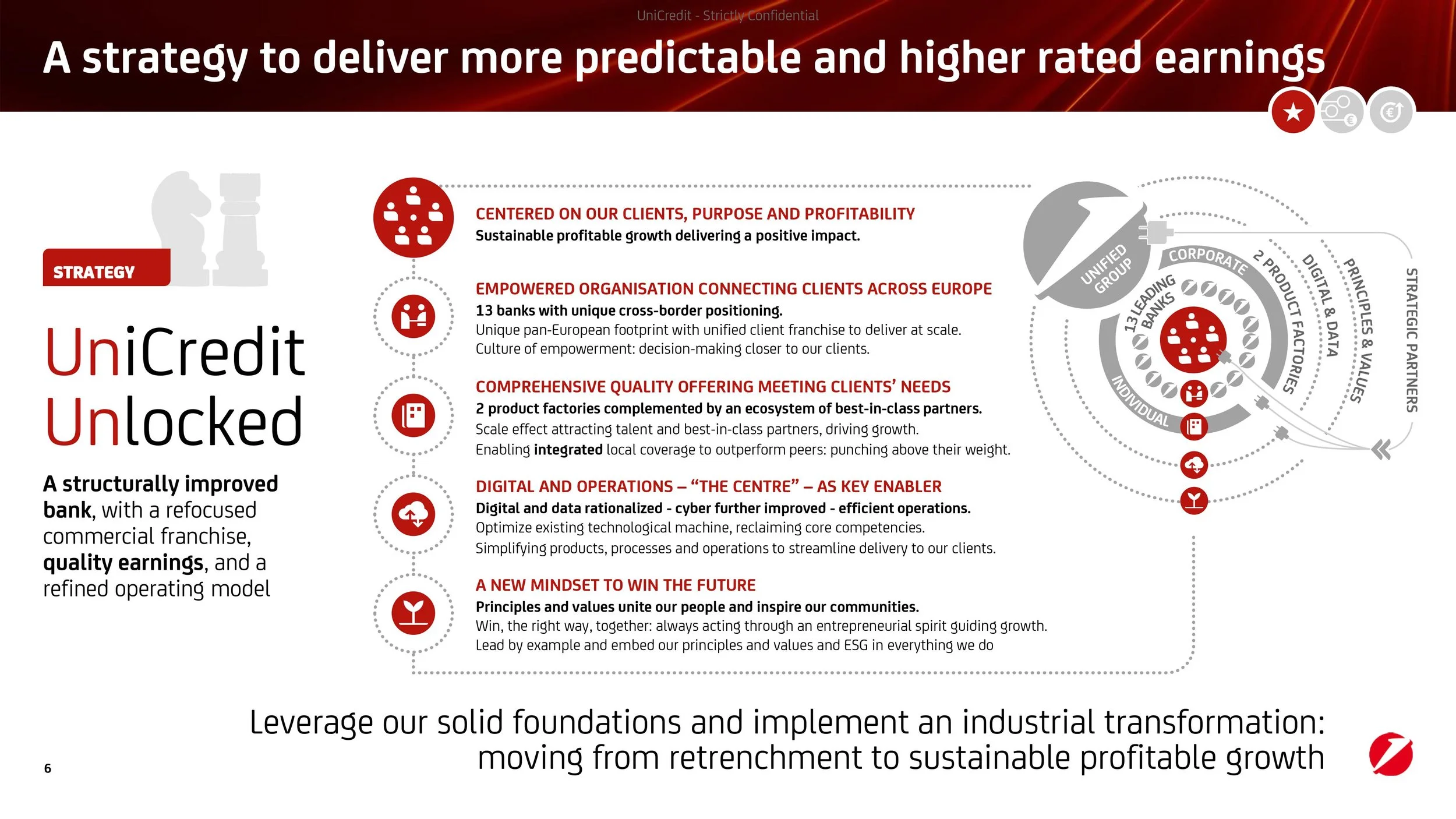

Our Strategy: UniCredit Unlocked

Grow in our regions and develop our franchise

Change our business model and the way our people operate

Deliver economies of scale from our footprint

Transform our technology leveraging Digital and Data

Embed sustainability in everything we do

“We are investing in Digital and Data setting out a new way of working for our employees and pursuing a capital-light model with sustainability embedded.”

Things to know right now

Digital and Data

The company is investing in digital to be a bank for the future. Using data and AI they will transform the business.

Leveraging three global pillars of technology, data and business they will deliver last mile customer products tailored to local needs.

UniCredit Unlocked

The company’s strategy to deliver more predictable and higher rated earnings.

UniCredit recognised as a top employer

In January 2023 UniCredit was recognised as a top employer in Austria, Bulgaria, Germany, Hungary, Italy and Serbia by the Top Employers Institute

What does each business unit do?

Client Solutions

This unit provides recurring and scalable capital-light offerings that are sold across the four operating regions listed below.

It accounts for 45% of the group’s revenues (but note these are embedded and not additional to the regions below)

Italy

This division represents approximately 48% of group revenues.

UniCredit for Italy is a plan to actively support their clients and local communities.

Euromoney awarded them Best Bank in Italy 2022, who also list them as the Market Leader in Corporate Banking, Corporate Social Responsibility, and Digital Solutions.

Germany

Germany represents approximately 24% of group revenues.

They have a strong focus on Green Loans with 18% of the market share.

They have launched a retail transformation programme with “Smart Banking” - a scalable multi-channel operating model for 1.3m mass market customers.

Central Europe

Central Europe represents approximately 17% of group revenues.

Bank Austria is #1 bank for ESG related bonds, demonstrating their focus on sustainability.

More than 8000 accounts have been provided to Ukrainians in Czech Republic and Slovakia to support them through the war.

An ongoing digitisation programme is in place - 55,000 Czech accounts opened with 30% of loans sold via mobile.

Small business lending has been redesigned in Hungary with 5 days to decision

A new fully digital cash loan product has been launched in Slovenia

Eastern Europe

Eastern Europe represents 13% of the group revenue.

Continued focus on digital demonstrated through mobile cash loans prodicts in Bulgaria, Croatia and Romania.

Remote advisory being provided in Croatia.

#1 financial app in Bulgaria with >1m downloads

Their Competitors

Typically regional/national banks across Europe

ING

BNP Paribas

Their Financial Calendar

Q1: January-March - Earnings 5th May 2022

Q2: April-June - Earnings 27th July 2022

Q3: July-September - Earnings 26th October 2022

Q4: October-December - Earnings 6th 31st January 2023

Next Earnings Report:

Around 5th May 2023

Positives from the Q4FY22 earnings report:

Fourth quarter was eight consecutive quarter of growth

€5.19bn revenues - highest ever

Strong interest rate increases improved revenues and profitability

Challenges from the Q4FY22 earnings report:

Volatility and uncertainty in the market impacting client sentiment, M&A and underwriting

Highest inflation in the history of the Euro

Prolonged war in Ukraine resulting in impacts to eastern European and Russian business.