How to research

Simple strategies to help you understand an industry or account

Researching an industry or account is a core skill for an SDR, and as you move to becoming an AE you’ll spend even more time on this activity.

Truly understanding how different companies work, how they make money and how they compete gives you insight into how you might be able to help them.

Here are some simple steps you can follow to become an expert researcher.

Download a canvas

Guides your thinking as you research an industry, territory or customer segment

Guides your thinking as you research an individual account.

Research analysts

Analyst firms publish regular reports on industries, regions and sectors. Some of these are paid but many are published for free or in exchange for an email address.

These three are the biggest analysts by size, but also search for niche firms focused on your target industry:

Consulting Firms

Companies use consulting firms to guide their thinking.

And to win their business the consulting firms publish their perspective on industries, geographies and segments.

Borrow it.

Dig Deeper

Look for niche consulting firms who may have unique insights

Customers and competitors

Customers

Who are the biggest customers in this segment (even if not in your territory)?

What do they talk about on their website?

What events have they hosted?

Who do they partner with?

What challenges are their customers facing?

What do they say in their annual report (for public companies)?

Competitors

What are your competitors writing related to this industry or segment?

What events are they hosting?

What is their perspective and how does it compare to yours?

What customers do they have in this industry?

What problems were those customers trying to solve?

What to look for in an Annual Report

The Chief Executive’s overview

The CEO will describe the highlights and main challenges of the preceding year.

They will likely mention any large acquisitions or divestments.

Remember that the annual report ‘sells’ the company’s stock as an investment and will focus more on the highlights than the challenges.

Risks to the business

Any public company registered in the US must submit a 10-K each year which includes the company’s explanation of potential risks to the business.

Often these are high level “geo-political challenges” or “inability to develop new products” but may indicate how the company thinks about the future.

Profit and Loss

This statement shows whether the company made any money from its operations over the period.

Specifically look for Cost of Sales - how much did it cost to make and sell the products or services that they sold.

Then look for net income and the earnings per share (EPS). Is this up or down on last year?

Balance Sheet

The balance sheet shows the financial health of the company.

On one side it shows the company’s assets in terms of cash, debtors, buildings and machinery.

On the other side it shows what the company owes in terms of loans, debts and shareholder equity.

Cash Flow

The cash flow statement shows how money flowed into and out of the business.

Was the company able to pay down debts or repurchase stock?

Did the company pay dividends to shareholders?

This helps understand how the company might handle future situations.

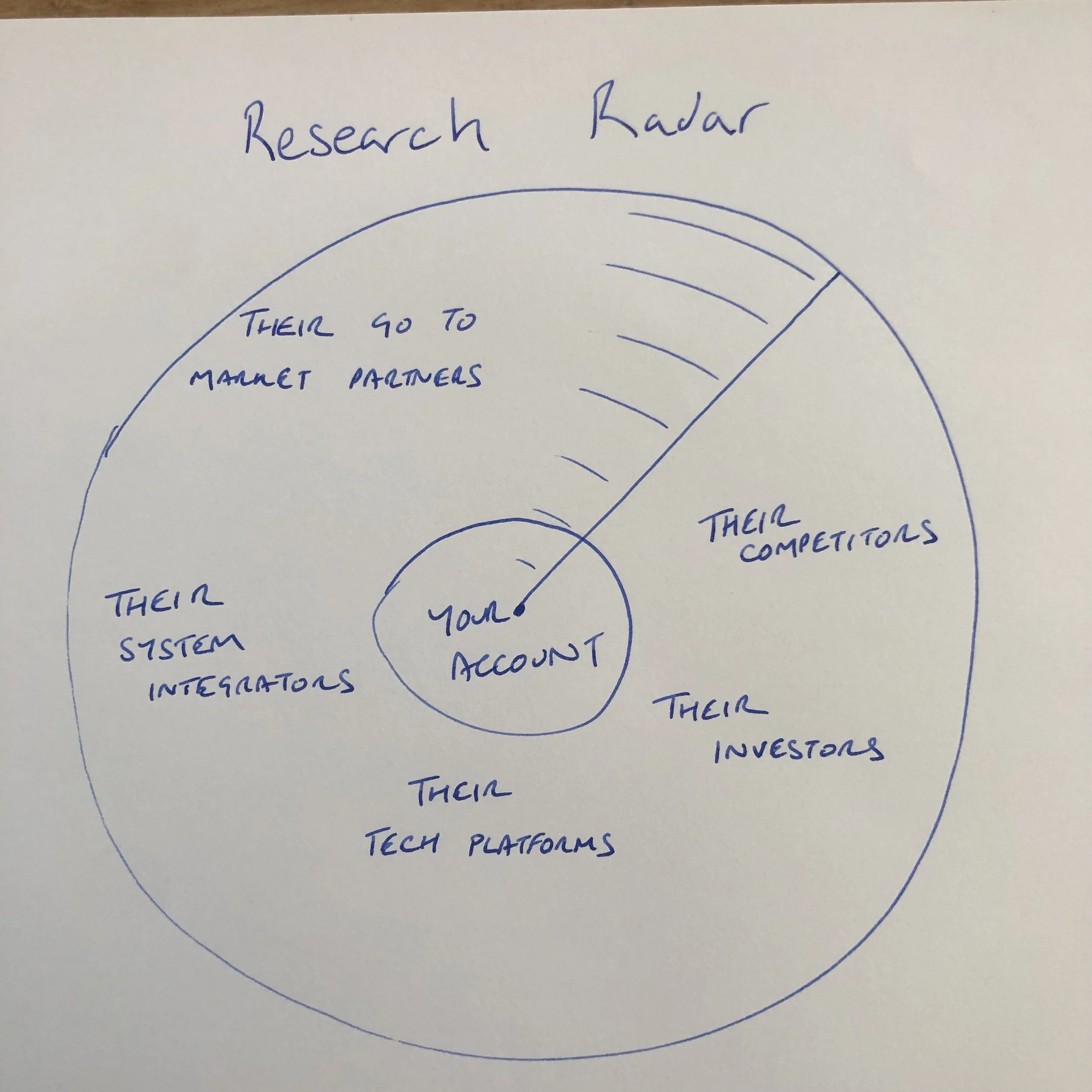

I like to think of a research radar.

Instead of just researching the company and their website, go further.

Three rules of research

Don’t research during prime calling time.

Keep research relevant. You don’t need to find out where your customer’s children study.

Use what you learn to create a unique perspective.

How can I help you?

A 60 minute pre-recorded working session in which I will guide you through understanding your customer’s industry challenges.

A 60 minute pre-recorded working session in which I will help you create a unique point of view to use for prospecting into this industry.

Seven free canvases to print out and aid your research, qualification, negotiation and forecasting.