Pfizer

Pfizer is a biopharmaceutical company that develops new medicines and vaccines to save and change the lives of people around the world suffering from all types of diseases.

You might know of them from their COVID-19 vaccine.

Employees: 79,000

Revenue: $100.3 billion for FY2022

HQ Location: Manhattan, New York, USA

What they do:

They innovate, discover, develop and provide over 150 different medicines and vaccines to millions of people across the world

Their portfolio also includes many well-known consumer healthcare products

There are 6 divisions of Pfizer: Consumer Healthcare, Inflammation and Immunology, Internal Medicine, Oncology, Rare diseases, and Vaccines

Their vision and priorities:

Their vision is to find the best science in the world, in order to be the best innovator to bring medicines and therapies to the world faster.

Their priorities focus on six areas: product innovation, access to products at a fair price, product quality and safety, diversity, equity and inclusion, climate change, and business ethics.

“Breakthroughs that change patients’ lives”

Business Goals and future predictions

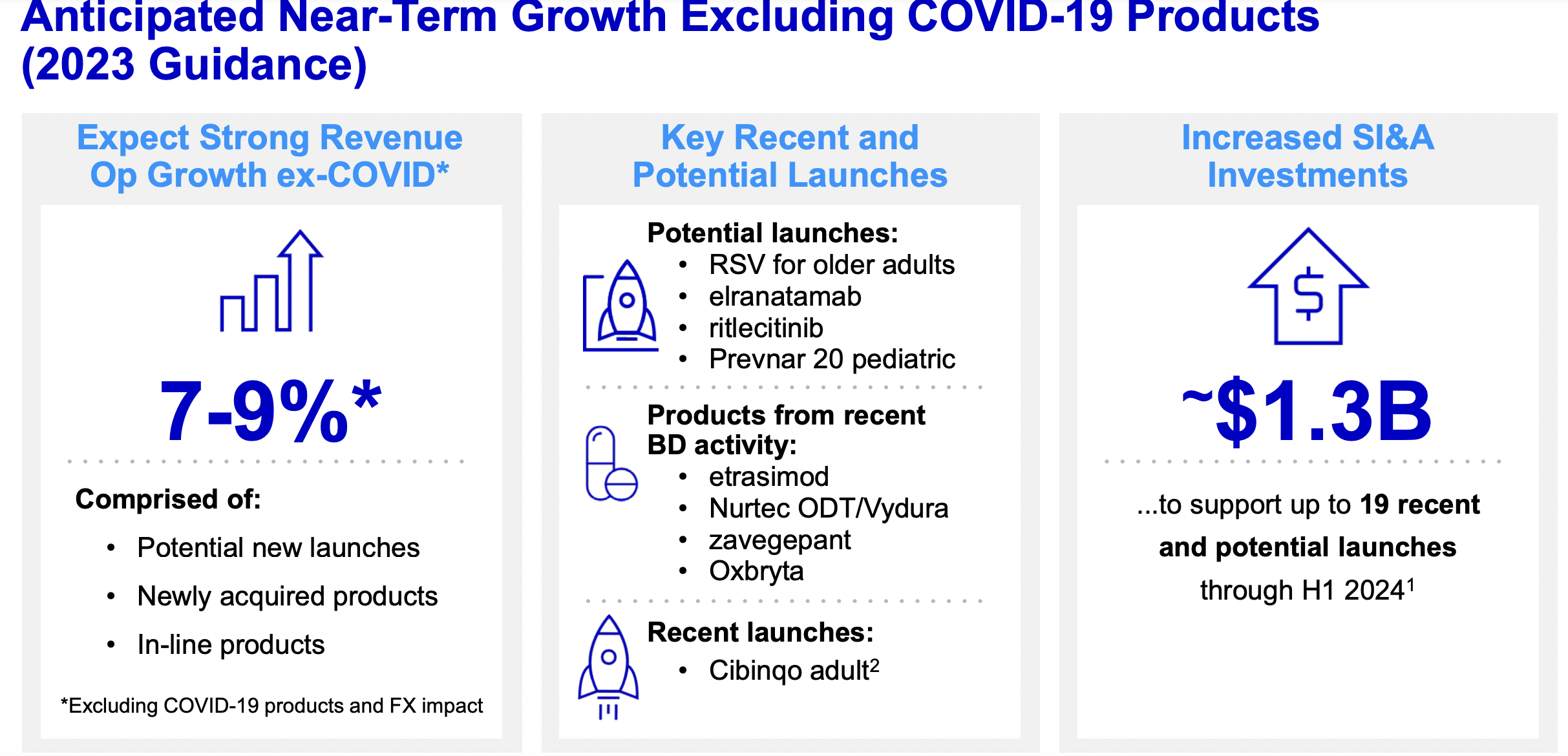

Excluding COVID-19 products, the Company continues to expect 7% to 9% operational revenue growth in 2023

15 - 19 potential launches planned from their internal pipeline to generate 2030 revenues that will more than offset the expected LOE losses forecast for '25 to 2030

The deals they have already done for Arena, Biohaven, Global Blood Therapeutics, and ReViral are predicted potentially to get them approximately $10.5 billion in expected 2030 revenues

Revenues are expected to be between $67 billion to $71 billion for 2023 lower than in 2022. The total company revenue declines will be driven by their COVID products, which are expected to go from their peak in 2020 to their low point in '23 before potentially returning to growth in '24 and beyond.

Revenues, excluding Covid, are expected to grow 7-9% in 2023. Growth is projected to be split between contributions from their new product launches, their recently acquired products as well as their online portfolio.

Things to know right now

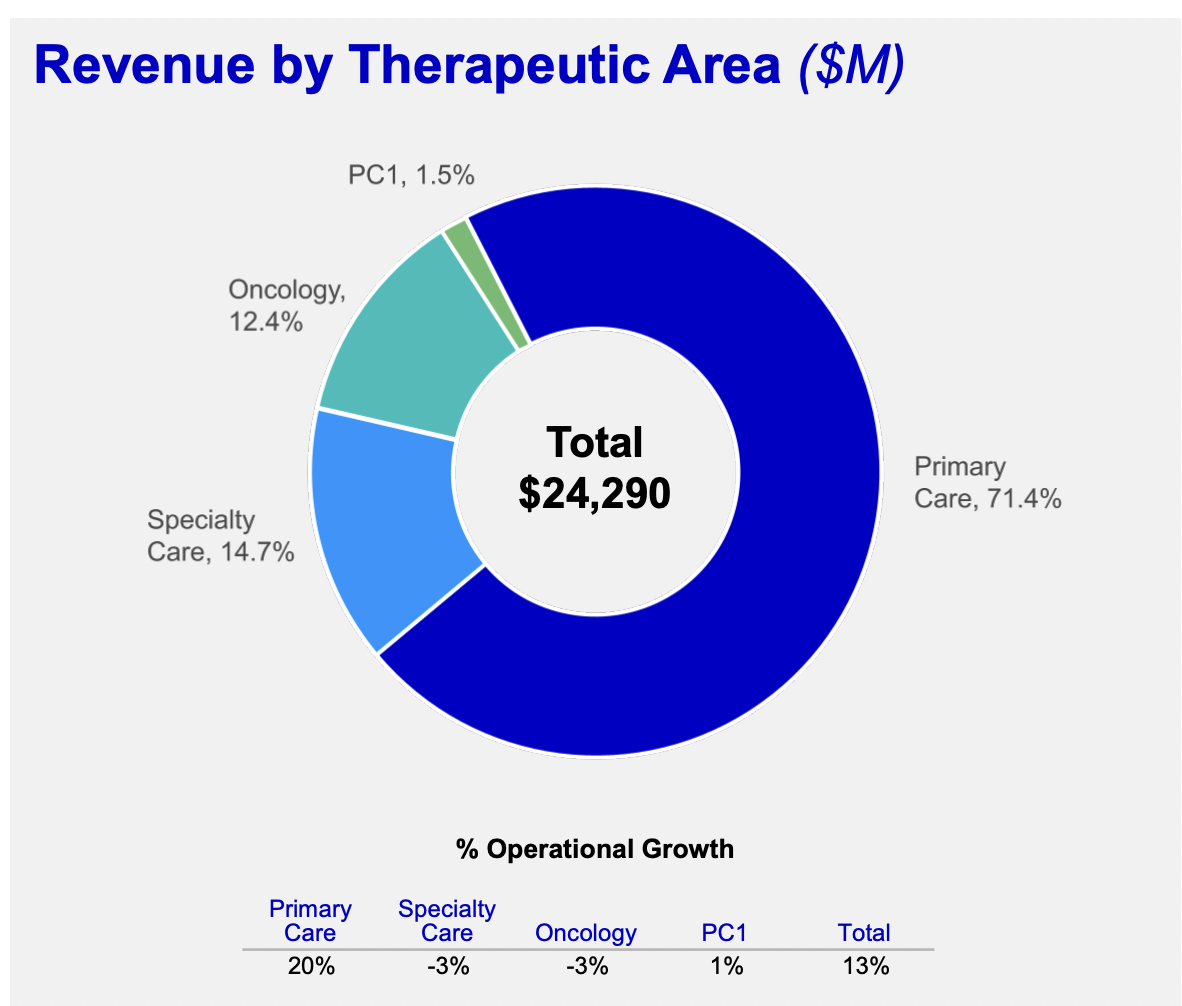

A new commercial structure has been established in the global biopharmaceutical business

The structure focuses on 3 broad therapeutic areas: primary care, specialty care, and oncology. The new structure has been developed to maximize the commercial success of all the new product launches taking place over the next few years.

Recent Company Acquisitions

Pfizer announced the completion of its acquisition of Global Blood Therapeutics, Inc. and it announced the completion of its acquisition of all the outstanding shares of Biohaven Pharmaceutical Holding Company Ltd. (Biohaven) not already owned by Pfizer.

Exceeded $100 bn in revenues for the first time in their 174-year history

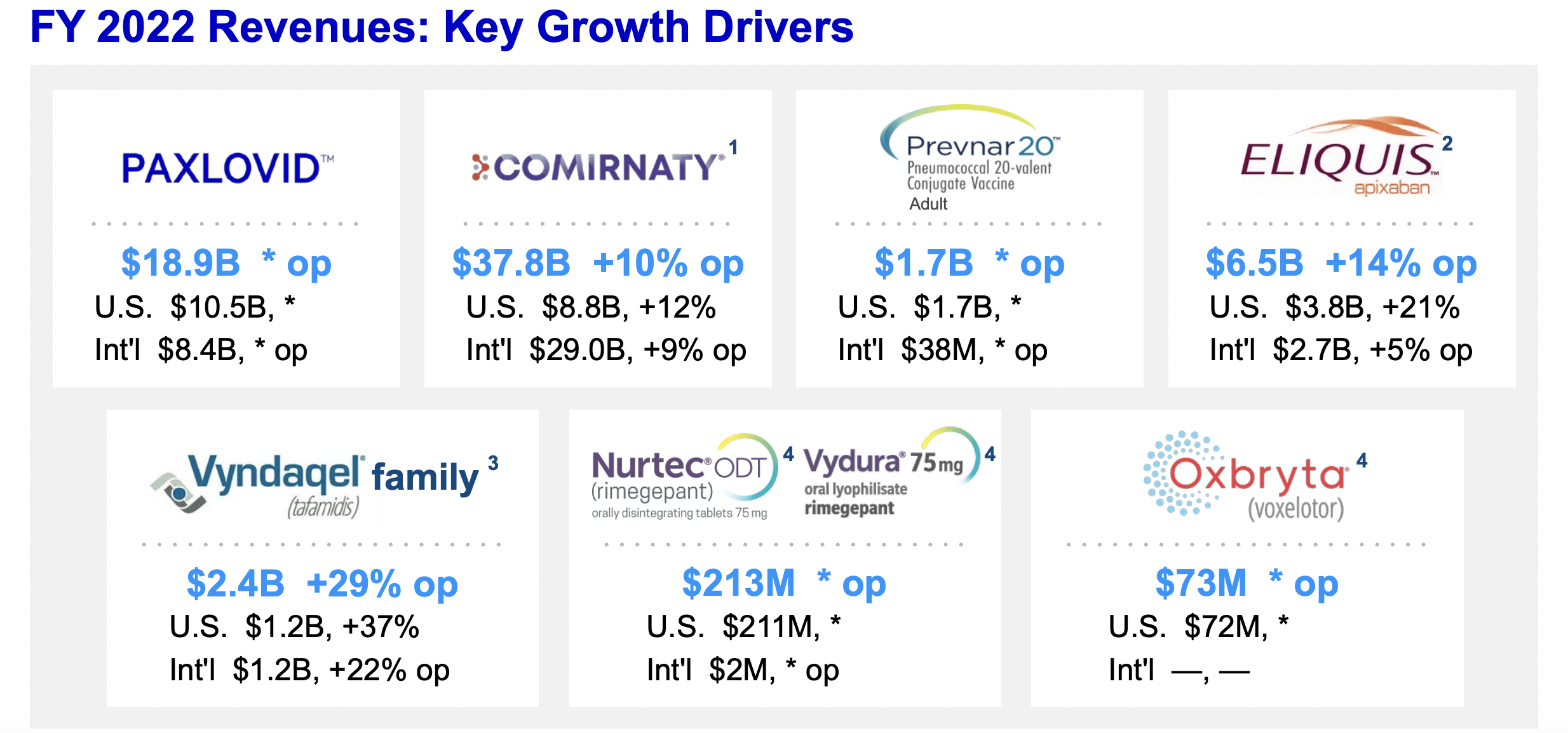

Their key growth drivers for the full year 2022 included global sales of PAXLOVID, strong growth of COMIRNATY in developed markets, the launch of Prevnar 20 for the adult population in the U.S., the continued strong growth of Eliquis globally, the strength of their VYNDAQEL family globally and the addition of newly acquired products, Nurtec ODT, VYDURA, and Oxbryta.

What does each business unit do?

Consumer Healthcare

This business group focuses on over-the-counter drugs that include medicines that are sold to consumers directly without a prescription from a medical professional.

Inflammation and Immunology

This business group focuses on discovering the next generation of therapies for immune-mediated diseases. Those diseases where the immune cells act abnormally attacking the body or displaying abnormal behavior in the body.

Internal Medicine

This business group focuses on treatments and therapies in neuroscience and pain, cardiovascular and metabolic.

Oncology

This business group focuses on creating a pipeline of new cancer drugs, treatments, and clinical trials that improve the outlook for cancer patients worldwide.

Rare Disease

This business group focuses on an adaptive and collaborative approach to the development of new medicines for patients with rare diseases.

Vaccines

This business group focuses on advancing vaccines for additional serious childhood, adolescent, and adult infections including meningococcal disease, influenza, Lyme disease, and more in addition to its Covid-19 vaccine.

Competitors

Roche

Johnson & Johnson

Abbot

Merck

AbbVie

Their financial calendar

Q1: January-March - Earnings 3rd May

Q2: April-June - Earnings 28th July

Q3: July-September - Earnings 1st November

Q4: September-December - Earnings 31st January

Next Earnings Report:

Around 3rd May 2023

Positives from the last earnings report Q4(FY22):

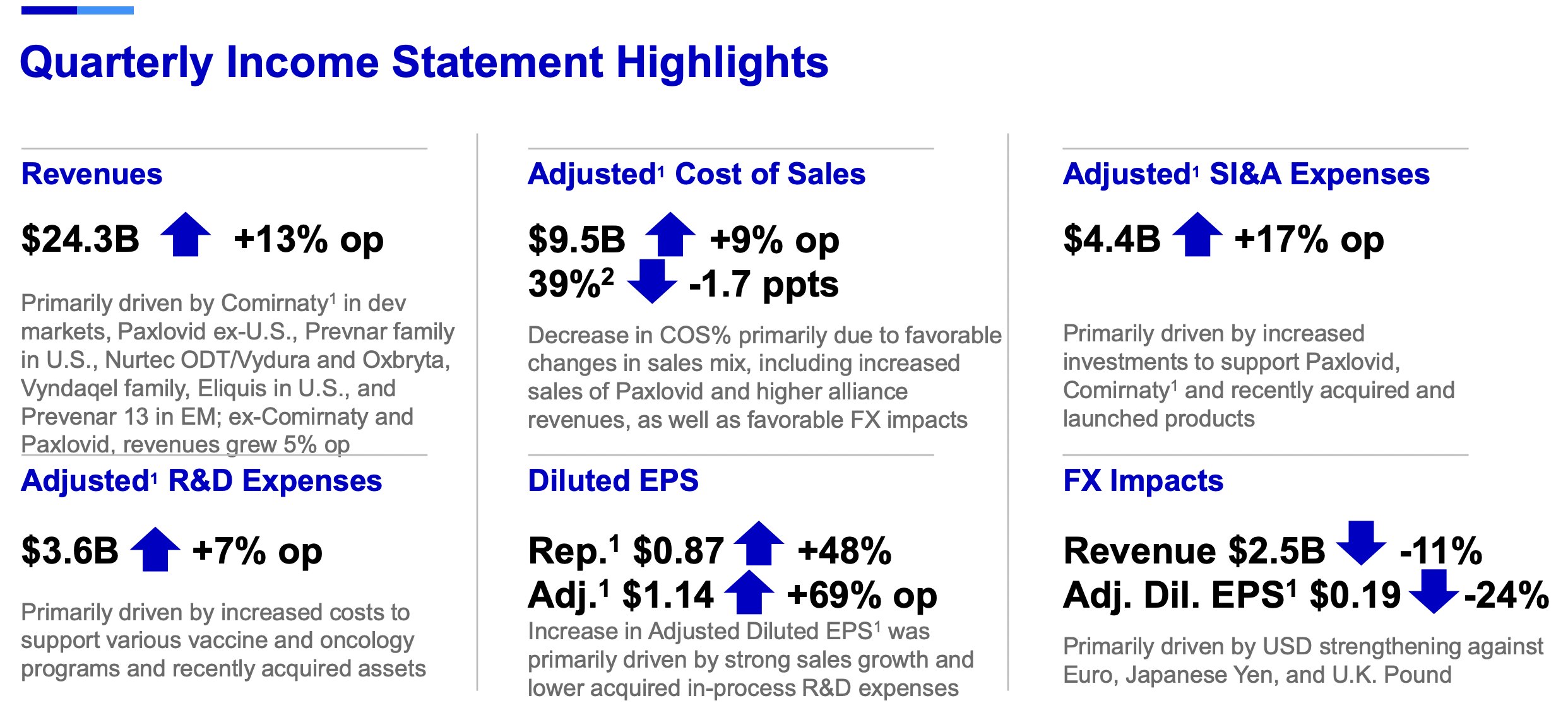

Fourth-quarter 2022 revenues totaled $24.3 billion, an increase of $452 million, or 2%, compared to the prior-year quarter, reflecting operational growth of $3.0 billion, or 13%

Excluding contributions from Paxlovid and Comirnaty, company revenues grew $571 million, or 5%, operationally.

Fourth quarter growth due to:

Comirnaty is up 67% driven by the resumption of deliveries of the Omnicron-adaptive booster

Paxlovid outside the U.S., which contributed $1.8 billion in revenues, driven by international launches in late 2021 and early 2022 following regulatory approvals or emergency use authorizations

Prevnar family (Prevnar 13 & 20) in the U.S., up 79%, driven primarily by strong patient demand following the launch of Prevnar 20 for the eligible adult population and favorable timing of Centers for Disease Control and Prevention (CDC) purchasing of the pediatric indication

Revenues from recently acquired products, Nurtec ODT/Vydura and Oxbryta, which contributed $211 million and $73 million in global revenues, respectively

Vyndaqel family (Vyndaqel, Vyndamax, Vynmac) globally, up 31% operationally, driven by continued strong uptake of the transthyretin amyloid cardiomyopathy indication, primarily in developed Europe and the U.S

Eliquis in the U.S., up 17%, driven primarily by continued oral anti-coagulant adoption and market share gains in non-valvular atrial fibrillation, as well as favorable changes in channel mix;

Prevenar 13 in emerging markets, up 22% operationally, driven primarily by strong growth in China and favorable timing of sales to GAVI, the Vaccine Alliance

Challenges from the last earnings report Q4(FY22):

Lower revenues in the fourth quarter were due to:

Comirnaty in emerging markets, is down 81% operationally, primarily due to lower demand for COVID-19 vaccines

Xeljanz globally, down 28% operationally, driven primarily by declines in net price due to unfavorable changes in channel mix in the U.S. and decreased prescription volumes globally resulting from ongoing shifts in prescribing patterns related to label changes

Sutent globally, down 50% operationally, primarily driven by lower volume demand in Europe following its loss of exclusivity in January 2022

Ibrance globally, down 4% operationally, driven primarily by increases in the proportion of patients accessing Ibrance through the U.S. Patient Assistance Program, planned price decreases that recently went into effect in international developed markets and prior-year clinical trial purchases internationally, partially offset by higher volumes across multiple regions

Eliquis internationally, down 7% operationally, primarily driven by declines in certain emerging markets.

Highlights of 2022:

Full-year 2022 revenues totaled $100.3 billion, an increase of $19.0 billion, or 23%, compared to full-year 2021, reflecting operational growth of $24.6 billion, or 30%

Excluding the revenue growth contributed by Paxlovid and Comirnaty, revenues for the full year grew 2% operationally. Operational growth compared to the prior year was driven primarily by:

Global sales of Paxlovid

Strong growth of Comirnaty in developed markets

The launch of Prevnar 20 in the U.S. for the adult population

Continued strong growth of Eliquis globally

Vyndaqel family globally

Newly acquired products Nurtec ODT/Vydura and Oxbryta