Last Updated: 29th November 2022

Glencore is a global mining and commodity trading organisation with a presence across 6 continents and 35 countries.

Employees: 135,000

Revenue: $21.3bn EBITDA (not revenue) in FY21

HQ Location: Baar, Switzerland

What they do:

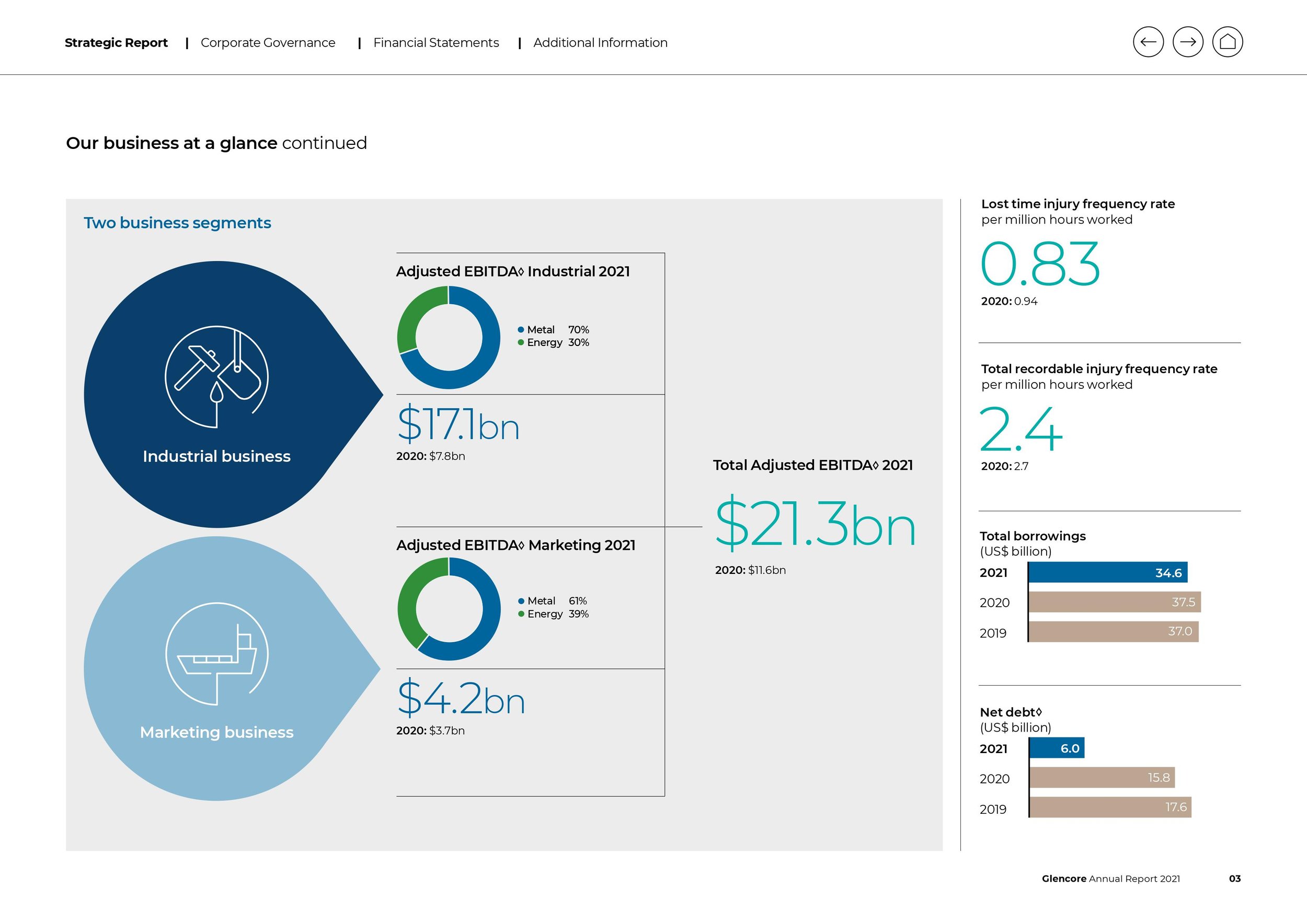

Two business segments - Industrial (mines that recover natural resources), and Marketing that buys and sells commodities around the world.

In FY21 Industrial segment had an EBITDA of $17.1bn while Marketing had an EBITDA of $4.2bn

(EBITDA is a measure of profitability and stands for Earnings before Interest, Tax, Depreciation and Ammortization)

Their vision and priorities:

Glencore has three strategic priorities

Responsible production and supply - the company has faced criticism in the past for not looking after the communities and regions where it has production assets.

Responsible portfolio management - the company is seeking to ensure it’s assets reflect the future needs of a sustainable world. That means a move towards metals and away from coal production.

Responsible product use - reinforcing the companies net zero objectives to ensure the end products are used in a sustainable fashion - limiting Scope 3 emmissions.

(Scope 3 emissions are those that occur when end customers use the products Glencore produces)

Financial Goals

Value for our shareholders - Adusted EBITDA and Net Income attributable to equity holders

Safe and Healthy workplace

Environmental performance

Long term value for the communities the company works in.

(It is noted there are no numbers attributed to these KPIs in the annual report)

Three things to know right now

Net zero 2050

The transition to a green future and a net zero company is the primary strategic objective for the CEO.

Goals are to reduce Scope 1+2+3 emissions by 15% by 2026 and by 50% by 2035 and to net zero by 2050.

Scope 1: reducing their own use of energy in their operations - mines and transportation mainly.

Scope 2: reducing energy use in their supply chain - machinery manufacture and other energy suppliers

Scope 3: reducing energy usage in their customers - primarily by moving them from carbon based fuels to electric vehicles and consumer products.

Governance

Glencore has been troubled by investigations related to bribery and how the organisation has behaved in local communities where they have production assets.

The company is working hard to settle these and has significant provisions in their budgets for the settling of these cases.

The company under new CEO Gary Nagle has a commitment to best in class ethics and compliance and is investing in compliance personnel, systems and external auditing.

New Leadership

Gary Nagle became CEO in 2021, replacing long time CEO Ivan Glasenberg who led the company for 19 years.

In addition Kalidas Madhavpeddi became Chairman, meaning a completely new leadership at the top of the business.

It is likely this will drive new programmes and direction into the business giving opportunities for change.

What does each business unit do?

Metals and Minerals

This business unit is part of the Industrial segment and focuses on mining. They have business units focusing on copper, cobalt, nickel, zinc, lead and ferroalloys (iron).

The segment has three main activities:

Exploration, acquisition and development of new sites

Extraction and production (mining)

Processing and refining (to make a more valuable end product)

Marketing

The marketing segment is responsible for trading, refining and transporting physical commodities.

Much of these will come from Glencore’s own industrial assets, but others will be purchased from other sources.

This segment has two main activities:

Logistics and delivery - shipping globally

Blending and optimisation - providing a higher quality end product

Energy

This division is also part of the Industrial segment and mines for thermal coal to be used in power stations and other industrial uses.

The segment has three main activities:

Exploration, acquisition and development of new sites

Extraction and production (mining)

Processing and refining (to make a more valuable end product)

Recycling

Glencore has ambitious net zero targets for 2050, and invests heavily in recycling.

As a result Glencore is a market leader in recycling of copper and other precious metals

Their financial calendar

Q1: January-March - Earnings 28th April

Q2: April-June - Earnings 4th August

Q3: July-September - Earnings 28th October

Q4: September-December - Earnings 2nd February

Positives from the last earnings report:

NOTE: Glencore provides quarterly production reports - the main earnings are covered in their half year and annual reports.

Own sourced production of nickel (15% up), ferrochrome (4% up) and coal (7% up) was higher than 2021.

Entitlement interest oil production was 16% higher than 2021

Challenges from the last earnings report:

Operational performance over the third quarter was impacted by…. extreme weather in Australia, industrial action at nickel assets in Canada and Norway and supply chain issues in Kazakhstan from Russia/Ukraine war.

Full year forecasts have been reduced accordingly

Next Earnings Report:

Around 2nd February 2023

Want an overview for one of your accounts?

If you are focused on Enterprise accounts that are listed on a US or European stock market then you can apply for a similar overview for free.