Synopsys, Inc.

Synopsys, Inc. is the Silicon to Software™ partner for innovative companies developing the electronic products and software applications we rely on every day.

Synopsys has a long history of being a global leader in electronic design automation (EDA) and semiconductor IP and offers the industry's broadest portfolio of application security testing tools and services.

Employees: 19,000

Revenue: $5B for FY2022

HQ Location: Mountain View, California, United States

What they do:

Synopsys' Silicon to Software technologies and services are designed to help their customers—chip and system engineers and software developers—to speed up time to market, achieve the highest quality of results, mitigate risk, and maximize profitability.

Chip and system designers must determine how best to design, locate and connect the building blocks of chips, and to verify that the resulting design behaves as intended and can be manufactured efficiently and cost-effectively

Software developers are responsible for writing code that not only accomplishes its goals as efficiently as possible, but also runs securely and is free of defects. They offer products that can help developers write higher quality, more secure code by analyzing code for quality defects and known security vulnerabilities, adding intelligence and automation to the software testing process, and helping to eliminate defects in a systematic manner.

Their purpose:

They aim to be a key engineering catalyst towards this Smart Everything world as their mission is to enable innovation at the critical interplay between semiconductors and software.

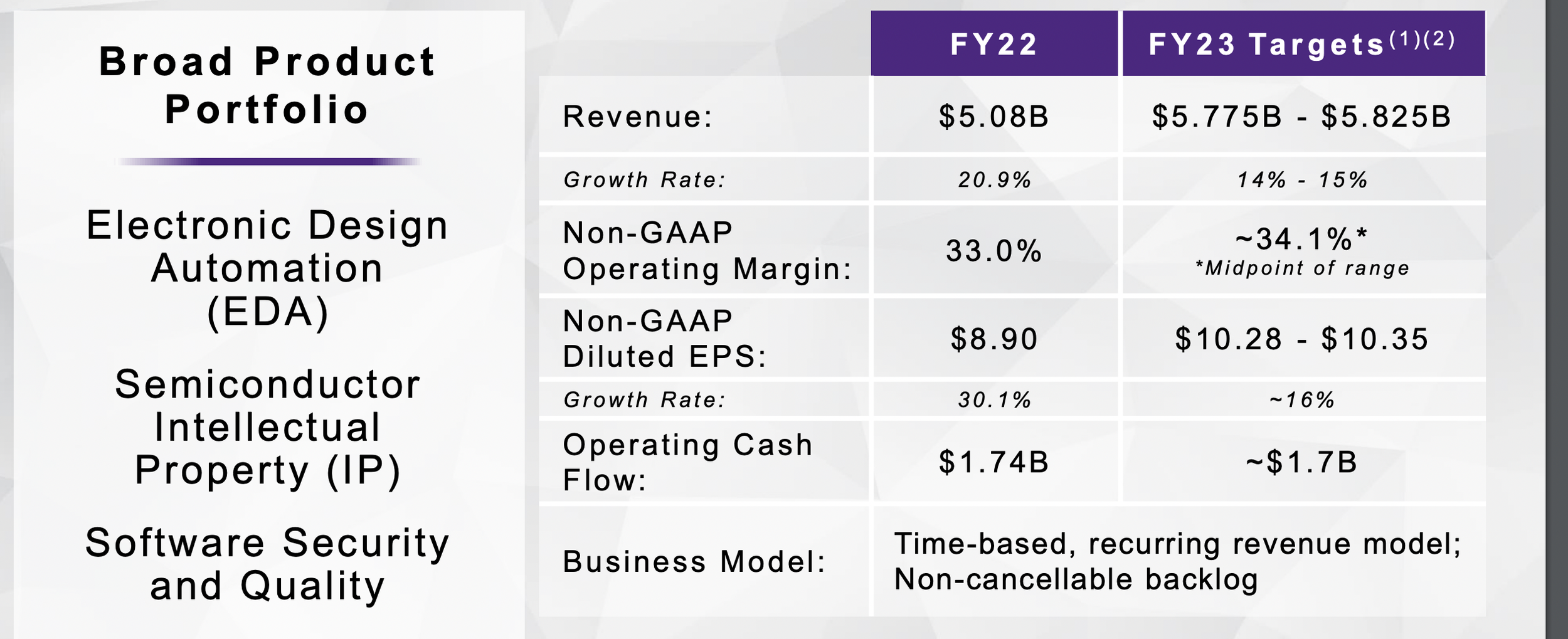

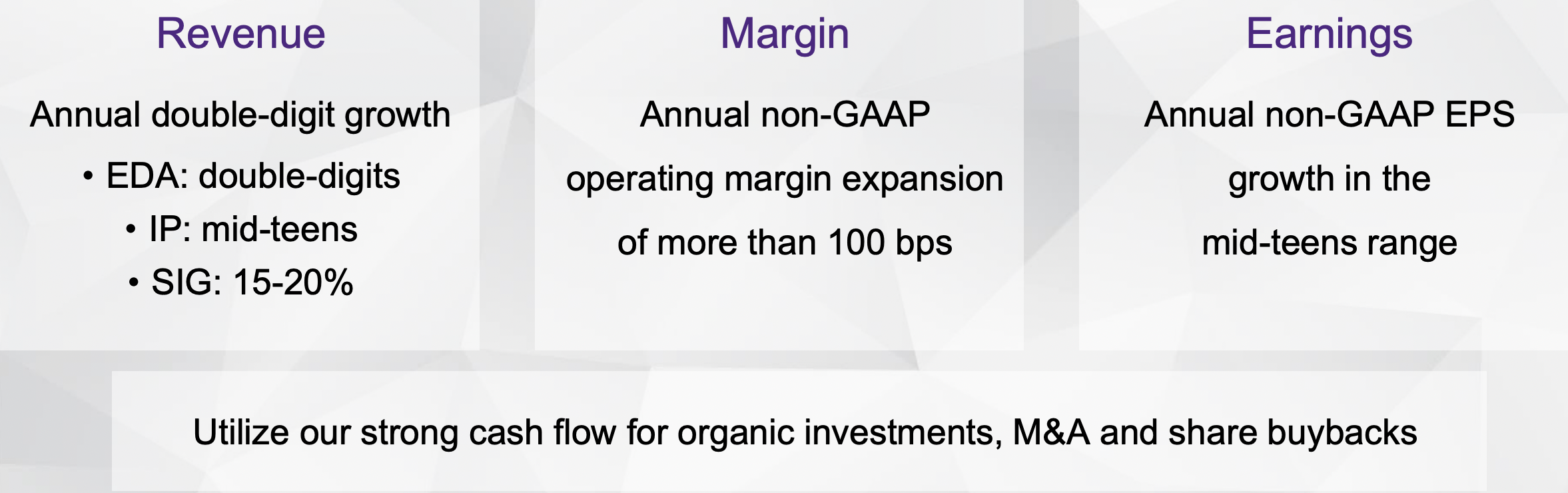

Financial and Business Goals

They are targeting 14-15% revenue growth in 2023

Continued non-GAAP operating margin expansion of 18-19% in 2023

Approximately 16% non-GAAP earnings per share growth in 2023

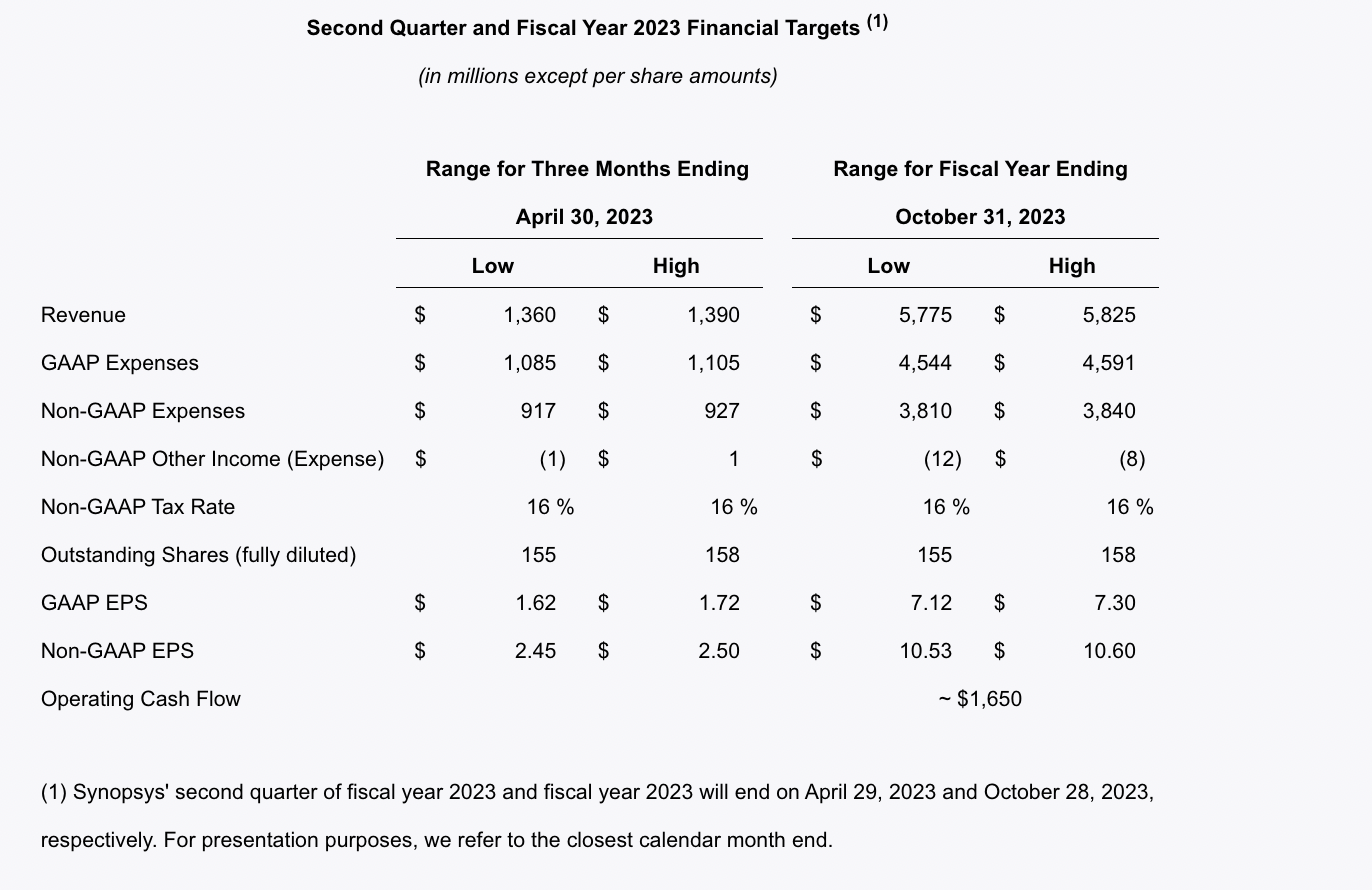

Q2 2023 Targets

Things to know right now

Shelagh Glaser is their new CFO

"She brings not only an outstanding track record of financial and operational experience in both software and semiconductor industries but superb experience scaling larger businesses while continually driving profitability. Her skills and experience, complemented by her positive energy and ability to manage complex business situations, will be a great asset to Synopsys to achieve our exciting growth ambitions." Aart de Geus, chairman and chief executive officer

Synopsys Initiates $300 Million Accelerated Share Repurchase Agreement

Synopsys has entered into an accelerated share repurchase agreement (ASR) with Wells Fargo Bank, NA to repurchase an aggregate of $300 million of Synopsys stock.

Synopsys introduced 3 business segments

Beginning in fiscal year 2023, Synopsys began reporting revenue and operating income in three segments:

Design automation

Design IP

Software Integrity

Business Segments:

Design Automation

This segment includes digital and custom integrated circuit (IC) design software, verification hardware and software products, manufacturing-related design products, field-programmable gate array (FPGA) design software, optical products, professional services, and other.

Design Automation is about 65% of their revenue.

Design IP

This segment includes Synopsys IP portfolio.

Intellectual Property(IP) System Integration

As more functionality converges into a single chip or even a multi-die system, the number of third-party IP blocks incorporated into designs is rapidly increasing. They provide the broadest, most comprehensive portfolio of high-quality, silicon-proven IP solutions.

Design IP is approximately 25% of their revenue.

Software Integrity

Their software integrity segment helps organizations align people, processes, and technology to intelligently address software risks across their portfolio and at all stages of the application lifecycle.

The testing tools, services, and programs enable their customers to manage open source license compliance and detect, prioritize, and remediate security vulnerabilities and defects across their entire software development lifecycle.

Their offerings include security and quality testing products, managed services, programs, professional services, and training offered as on-premises and cloud-based delivery.

Software Integrity is about 10% of their revenue.

Their Competitors

Atrenta

Arm

Cadence Digital Systems

Flipkart

Cadence

Their financial calendar

Q2: February-April - Earnings 18th May 2023

Q3: May-July - Earnings 17th August 2023

Q4: August-October - Earnings 30th November 2023

Q1: November-January - Earnings 15th February 2024

Next Earnings Report:

18th May 2023

Highlights from Fiscal 2022:

They crossed the $5 billion annual revenue milestone

They evolved their product offering, expanded customer relationships, and increased competitive differentiation.

They delivered another record year in fiscal 2022 with revenue growing 21% to $5.08 billion, with double-digit growth in all product groups and across all geographies.

Their hardware-based products delivered a record year with competitive momentum, adding more than 30 new logos and over 200 repeat orders.

Their automotive solutions had outstanding growth, especially with the acceleration of car electrification driven by urgent climate considerations notably driving a slew of new sensor, actuator, and control chip designs.

IP business delivered another record year with more than 20% growth, particularly strong demand is seen in key markets such as high-performance computing, automotive and mobile, where the systems are driven by smart everything, high-speed secure connectivity, and advanced process geometries

Customer solutions also saw strong market momentum this year, with more than 45 new logos this year, nearly one per week with double-digit revenue growth

DSO.ai artificial intelligence design solution

Continues to deliver amazing results

DSO.ai reduces efforts for months to weeks, while also delivering superior performance and reduced power

Results reported by customers include a 25% reduction in turnaround time and compute resources and up to 30% power reduction.

In FY 2022, the number of customers more than doubled, and they have already seen significant repeat orders and broadening proliferation.

Positives from the last earnings report Q1FY23:

All segments performed better than this quarter last year.

Revenue: $1.361 billion

GAAP earnings per diluted share: $1.75

Non-GAAP earnings per diluted share: $2.62

Design Automation segment revenue was $890 million with both EDA software and hardware performing well

Software Integrity revenue was $128 million and the adjusted operating margin was 12.1%

Design IP segment revenue was $344 million, and the adjusted operating margin was 34. 2%.