Kimberly-Clark Corporation

Kimberly-Clark Corporation is an American multinational personal care business that produces mostly paper-based consumer products.

The company manufactures sanitary paper products and surgical & medical instruments in 34 countries around the world.

Their brands are sold in more than 175 countries around the world and more than 1/4 of the world’s population uses one of their products every day.

Employees: 45,000

Revenue: $20.2 Billion FY2022

HQ Location: Irving, Texas, US

What they do:

Create products that help individuals’ essential needs.

Their portfolio of brands, including Huggies, Kleenex, Scott, Kotex, Cottonelle, Poise, Depend, Andrex, Pull-Ups, GoodNites, Intimus, Neve, Plenitud, Sweety, Softex, Viva and WypAll.

Their vision and priorities:

‘Better Care for a Better World’

To improve the wellbeing of 1 billion people by 2030 by increasing people’s access to clean water, safe sanitation, and hygiene through programs like “Toilets Change Lives” and partnerships with NGOs (Non-Governmental Organisations), including Water For People, WaterAid, and Plan International.

Reduce their Scope 1 and 2 greenhouse gas emissions by 50% and their Scope 3 emissions by 20% – all by 2030.

Develop more sustainable solutions for their global portfolio, including alternative fibers and plastics.

Financial and Business Goals

To elevate their core businesses in developed markets

To accelerate growth in developing and emerging markets.

Things to know right now

Nelson Urdaneta is appointed as the new CFO as Maria Henry retired.

2030 Ambition

The company has declared strategic goals for 2030, including advancing the wellbeing of 1 billion people, reducing their platsic use by 50%, reducing their natural (Northern) forest fiber usage by 50%, reducing their carbon footprint by 50%, reduce the water footprint of their mills by 50%

FORCE Programme focused on reducing costs

Focused on Reducing Costs Everywhere is an ongoing programme looking at supply chain savings. It has generated $3.7 billion of savings over last 10 years.

It looks at manufacturing productivity, product design, procurement and their distribution network.

What does each business unit do?

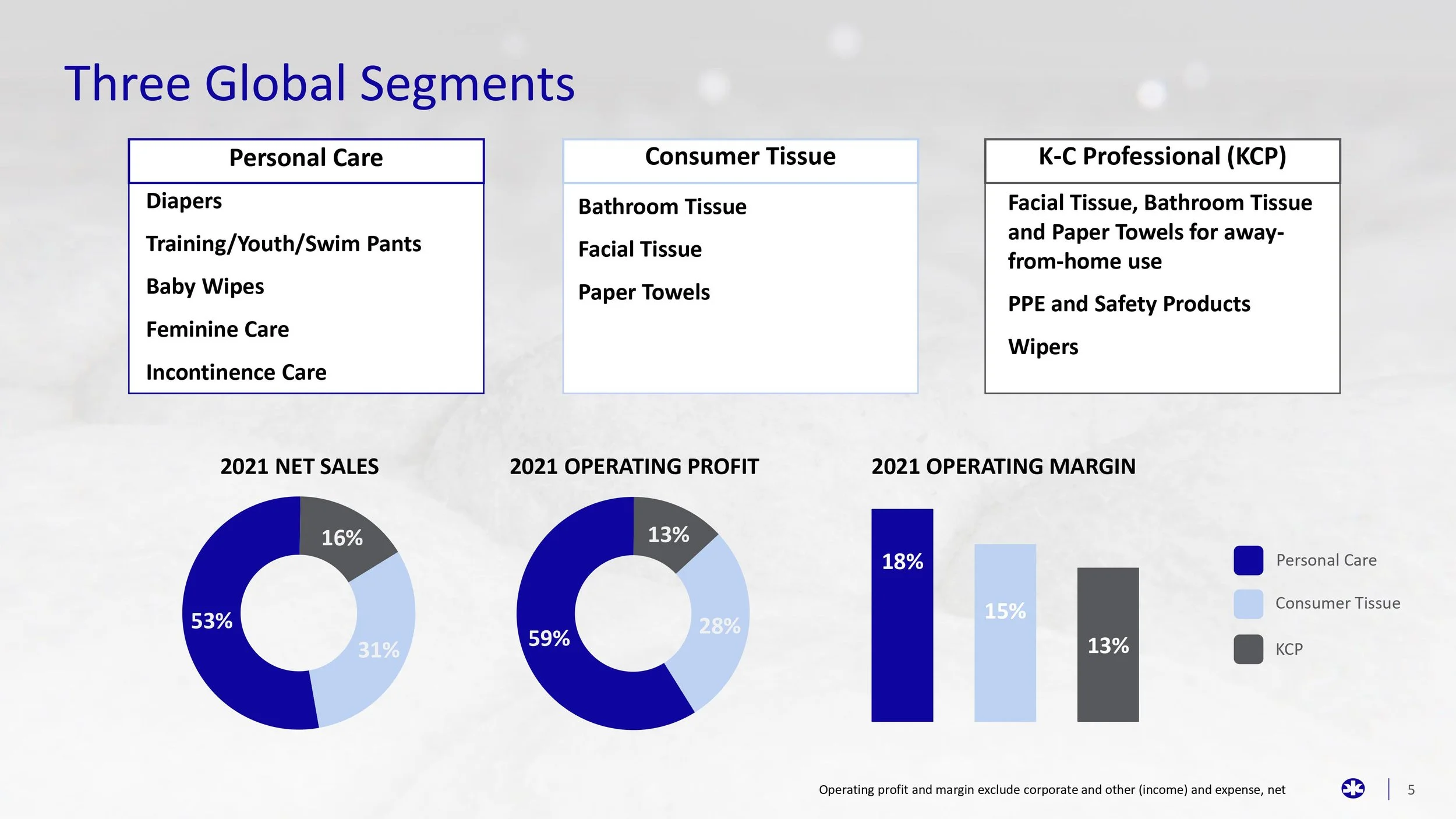

Personal Care Segment

This business unit offers customers a trusted partner to help them care for themselves through a variety of products such as disposable diapers, training, and youth pants, swim pants, baby wipes, and feminine and incontinence care products.

Product brands include Huggies, Little Swimmers, Pull-Ups, Good-Nites, DryNites, Sweety, Kotex, U by Kotex, Intimus, Depend, Plenitud, Softex, Poise, and other brand names.

Consumer Tissue Segment

This business unit manufactures and markets facial and bathroom tissue, paper towels and napkins for household use; wet wipes; and related products.

Product brands include Kleenex, Scott, Cottonelle, Viva, Andrex, Scottex, Neve, and others.

K-C Professional (KCP) Segment

This business segment dedicates itself to creating exceptional workplaces that are healthier, safer, and more productive.

They partner with businesses to make the working environment better by supplying wipes, tissues, towels, apparel, soaps, and sanitizers.

Their world-class portfolio of trusted, recognized brands includes Kleenex, Scott, WypAll, Kimtech, and KleenGuard.

Their Competitors

Unilever

Procter & Gamble

Lanco Infratech

Edgewell Personal Care

Clorox

Their financial calendar

Q1: January-March - Earnings 22nd April 2022

Q2: April-June - Earnings 26th July 2022

Q3: July-September - Earnings 25th October 2022

Q4: October-December - Earnings 25th January 2023

Next Earnings Report:

Around 22nd April 2023

Positives from the last earnings report (25th January 2023):

Fourth quarter 2022 net sales of $5. billion - flat with previous year

Organic sales increased 5% but were reduced by 5% foreign exchange affects

Fourth quarter operating profit was $712 million in 2022 and $521 million in 2021

Fourth quarter share repurchases were 0.2 million shares at a cost of $25 million, bringing full-year repurchases to 0.8 million shares at a cost of $100 million. Total debt was $8.4 billion at the end of 2022 and $8.6 billion at the end of 2021.

Personal Care Segment: Fourth quarter sales of $2.6 billion decreased 3 percent, including organic sales growth of 2 percent. Changes in foreign currency exchange rates reduced sales by 5 percent.

Consumer Tissue Segment: Fourth quarter sales of $1.6 billion was even with year-ago with organic sales up 5 percent. Net selling prices increased sales 11 percent while volumes declined 6 percent. Changes in foreign currency exchange rates reduced sales 5 percent.

K-C Professional (KCP) Segment: Fourth quarter sales of $0.8 billion increased 11 percent, including organic sales growth of 16 percent. Net selling prices rose 20 percent, product mix improved sales 1 point while volumes declined 5 percent. Changes in foreign currency exchange rates decreased sales 5 percent.

Challenges from the last earnings report:

Changes in foreign currency exchange rates reduced sales by 5%

The comparison with Q4 2021 was impacted by $245 million of higher input costs as well as lower volumes and the associated fixed cost under absorption. Unfavorable foreign currency effects and higher marketing, research and general expense also reduced operating profit in the quarter.

Cash provided by operations in the fourth quarter was $991 million in 2022 and $1,062 million in 2021

Personal Care: Sales in developed markets outside of North America decreased by 4%

Consumer Tissue: Sales in developed markets outside of North America decreased by 3%

K-C Professional (KCP): Sales were up in all regions globally, but affected heavily by foreign exchange impacts.

Full Year 2022 Results

Sales of $20.2 billion increased 4 percent. Organic sales increased 7 percent, as net selling prices rose 9 percent, product mix increased sales 1 point and volumes declined 3 percent.

Changes in foreign currency exchange rates decreased sales by approximately 4 percent. Operating profit was $2,681 million in 2022 and $2,561 million in 2021.

Results in 2022 include the net benefit of the acquisition of a controlling interest of Thinx and 2021 results include charges related to the 2018 Global Restructuring Program.

Adjusted operating profit was $2,617 million in 2022 and $2,836 million in 2021.

Results were impacted by $1.5 billion of higher input costs, higher marketing, research and general spending and unfavorable foreign currency effects. Results benefited from organic sales growth and $290 million of FORCE savings.