Fortinet

Fortinet is a pureplay cybersecurity company, providing security solutions to companies, service providers and governments across the globe.

Fortinet ranks #1 in the most security appliances shipped worldwide, and sits in an expanding addressable market of $180bn growing to $249bn by 2026.

Employees: 12,600

Revenue: $4.4bn for FY2022

HQ Location: Sunnyvale, California, U.S.

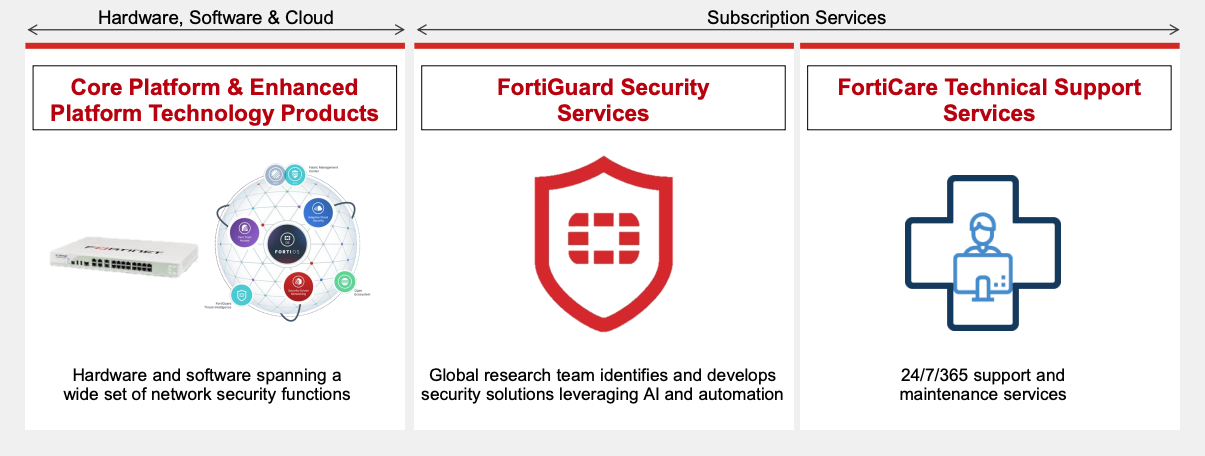

What they do:

They are a leader in the Cybersecurity industry securing devices and data across networks, endpoints and clouds

The business focuses on

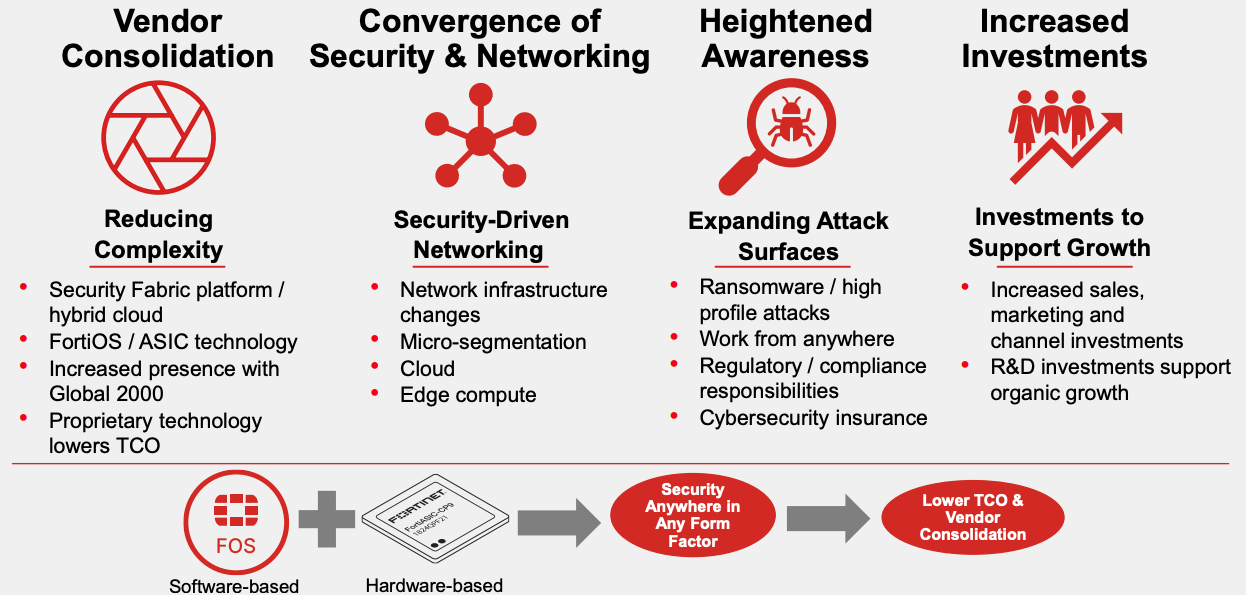

Convergence/Security-Driven Networking - enabling the convergence of networking and security across all edges

Zero-Trust Access - knowing and controlling who is on a network

Adaptive Cloud Security - virtual firewall and software products

AI-Driven Security Operations - products to identify, investigate and remediate cybercriminal incidents

Security as a Service - subscription to add to products to receive threat intelligence and updates

Support and Professional Services - technical support, updates and product warranties.

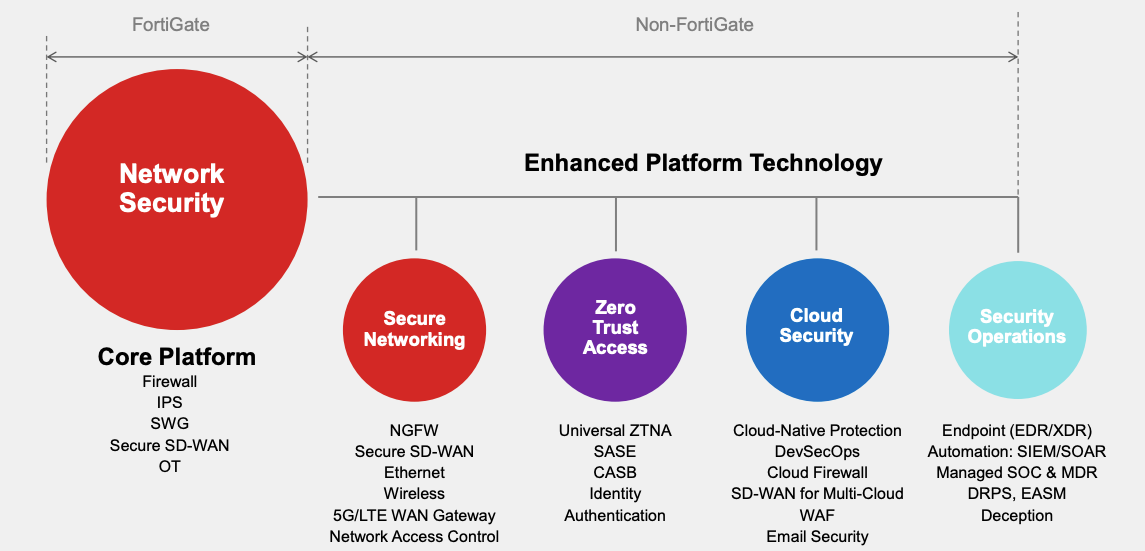

Their core product is the FortiGate range of firewall products, supported by a range of “Non-FortiGate” products that integrate and support the core offering.

Global Partner Programme

Fortinet is a channel-centric company with over 60,000 partners in its Engage Partner Program.

Their vision and priorities:

The company publishes targets for 2025

$10bn in billings, $8bn of revenue and >25% operating margin.

These numbers require a compound annual growth rate (CAGR) of 22% from today’s numbers.

The company’s long term target is to continue to execute the rule of 40 (i.e. the sum of revenue growth rate plus operating margin >40.

Core Platform and Enhanced Platform Technology are growth drivers. Enhanced (41% CAGR) is predicted to grow faster than Core (22% CAGR)

Things to know right now

Fortinet Growth Drivers

Continued expansion into Enterprise

The company continues to increase its presence in the Enterprise market. In Q3 FY22 the company did 365 deals over $1m totalling $878m - up 91% on the previous year.

Build versus Buy

The company has spent $1.8bn on innovation since 2017 to build out their integrated platform strategy

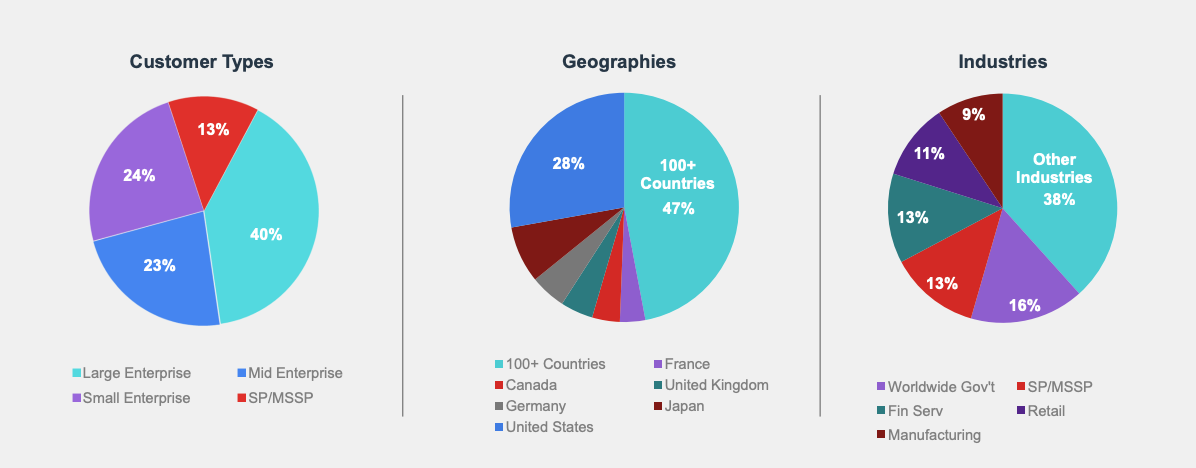

Highly diversified business

The company generates its revenue from a wide range of customers, geographies and industries.

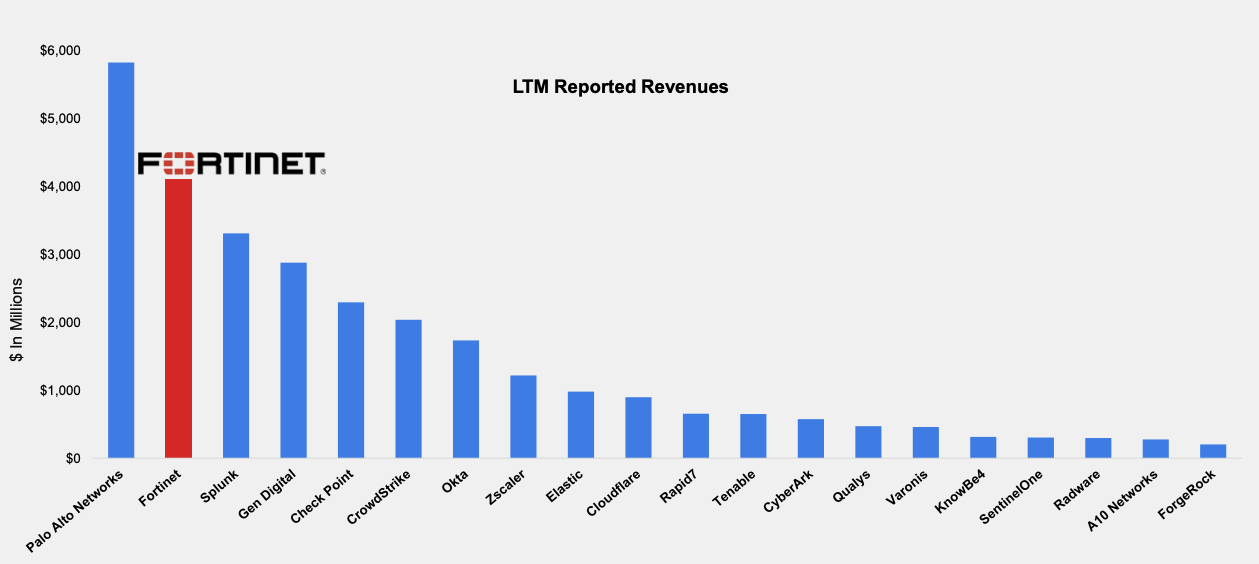

Their Competitors

The market for security is highly fragmented and ready for consolidation.

Their financial calendar

Q1: January-March - Around 4th May 2023

Q2: April-June - Earnings 3rd August 2022

Q3: July-September - Earnings 2nd November 2022

Q4: October-December- Around 7th February 2023

Next Earnings Report:

Around 4th May 2023

Positives from the last earnings report (Q4 FY22):

Product revenue $540.1m, up 43% on previous year

Services revenue $742.9m, up 27% on previous year

Total revenue $1.28b, up 33% on previous year

GAAP Operating margin of 27.9%