eBay, Inc.

eBay is a global commerce leader through their Marketplace platforms that connect millions of buyers and sellers in more than 190 markets around the world.

The platforms include their online marketplace located at www.ebay.com and its localized counterparts, including an off-platform business in Japan, as well as eBay’s suite of mobile apps.

Employees: 10,800 +

Revenue: $9.795B for FY2022

HQ Location: San Jose, California, U.S.

What they do:

Their technologies and services are designed to provide buyers with choice and a breadth of relevant inventory from around the globe

They enable sellers’ access to eBay’s 134 million buyers worldwide.

Their business model and pricing are designed so that their business is successful when their sellers are successful.

They earn revenue primarily through fees collected on paid sales, inclusive of payment processing and first-party advertising.

Their Marketplace platforms are accessible through an online experience (e.g. desktop and laptop computers), iOS and Android mobile devices (e.g. smartphones and tablets), and their application programming interfaces (“APIs,” platform access for third-party software developers).

They manage payments for all transactions on their Marketplace platforms, delivering buyers and sellers a simplified end-to-end payments experience.

Through managed payments, they are able to provide a frictionless experience for current and next-generation customers, consistent with today’s retail standards.

They offer buyers more flexibility and choice in how they’d like to pay and offer sellers a more streamlined way to run their businesses.

Their vision and priorities:

To connect people and build communities to create economic opportunities for all

Financial and Business Goals for Q1 FY23

Outlook 2023

GMV stands for Gross Merchandise Value - the value of of the goods sold on the platform, which is different to eBay’s revenue which is their fees.

Things to know right now

Acquisition of TCGplayer

In October 2022, they completed the acquisition of TCGplayer for $228 million. TCGplayer is a trusted marketplace offering more selection for collectible card game enthusiasts.

Quick Setup launched

For sellers who use Promoted Listings Advanced, eBay launched Quick Setup, a one-click campaign creation solution where eBay automates and optimizes the campaign structure, ad groups, targeting, and keyword bids. The company also introduced multi-user account access across the full suite of Promoted Listings, which enables eBay sellers to delegate campaign management to trusted third parties like brands or ad agencies.

Split Payments introduced in the US

eBay introduced split payments in the U.S. for transactions over $1,000, enabling buyers to spread large purchases across two credit cards.

ZipPay introduced in Australia

In Australia, eBay launched ZipPay and ZipMoney as additional Buy Now, Pay Later options for eligible customers. With the introduction of ZipMoney, eBay buyers can enjoy up to six months of interest-free payment installments for items like luxury handbags, smartphones, and car parts.

3PM Shield Acquired

In February 2023, eBay acquired 3PM Shield, a provider of advanced AI-based marketplace compliance solutions. This acquisition further enhances eBay’s world-class monitoring solutions with technologies designed to prevent the sale of counterfeit items, unsafe products, and illegal goods, and is part of eBay’s ongoing commitment to providing sellers and buyers with a safe and trusted platform.

500 jobs eliminated at eBay

Roughly 4% of their global employee base jobs have been made redundant. This decision followed a thoughtful review of their organization to ensure their people and roles were aligned with priorities that advance eBay's commitment to long-term sustainable growth. These changes provide additional flexibility for them to invest efficiently and create new roles in high-potential areas of their business like new technologies, trusted customer experiences, and key markets.

Operating Business Segment:

They have one reportable segment which reflects the way management and their chief operating decision-maker review and assess the performance of the business.

Marketplace

This is their online marketplace located at www.ebay.com, its localized counterparts, and the eBay suite of mobile apps.

Revenues are attributed to U.S. and international geographies primarily based upon the country in which the seller, platform that displays advertising, another service provider, or customer, as the case may be, is located.

Key Operating Metrics

Gross Merchandise Volume (“GMV”) and take rate are significant factors that they believe affect their net revenues.

GMV consists of the total value of all paid transactions between users on their platforms during the applicable period inclusive of shipping fees and taxes.

Take rate is defined as net revenues divided by GMV and represents net revenue as a percentage of overall volume on our platforms.

Competitors

amazon.com

walmart.com

etsy.com

aliexpress.com

Their financial calendar

Q1: February-April - Around 4th May 2023

Q2: May-July - Around 3rd August 2023

Q3: August -October - Around 2nd November 2023

Q4: November -January - Around 22nd February 2023

Next Earnings Report:

Around 4th May 2023

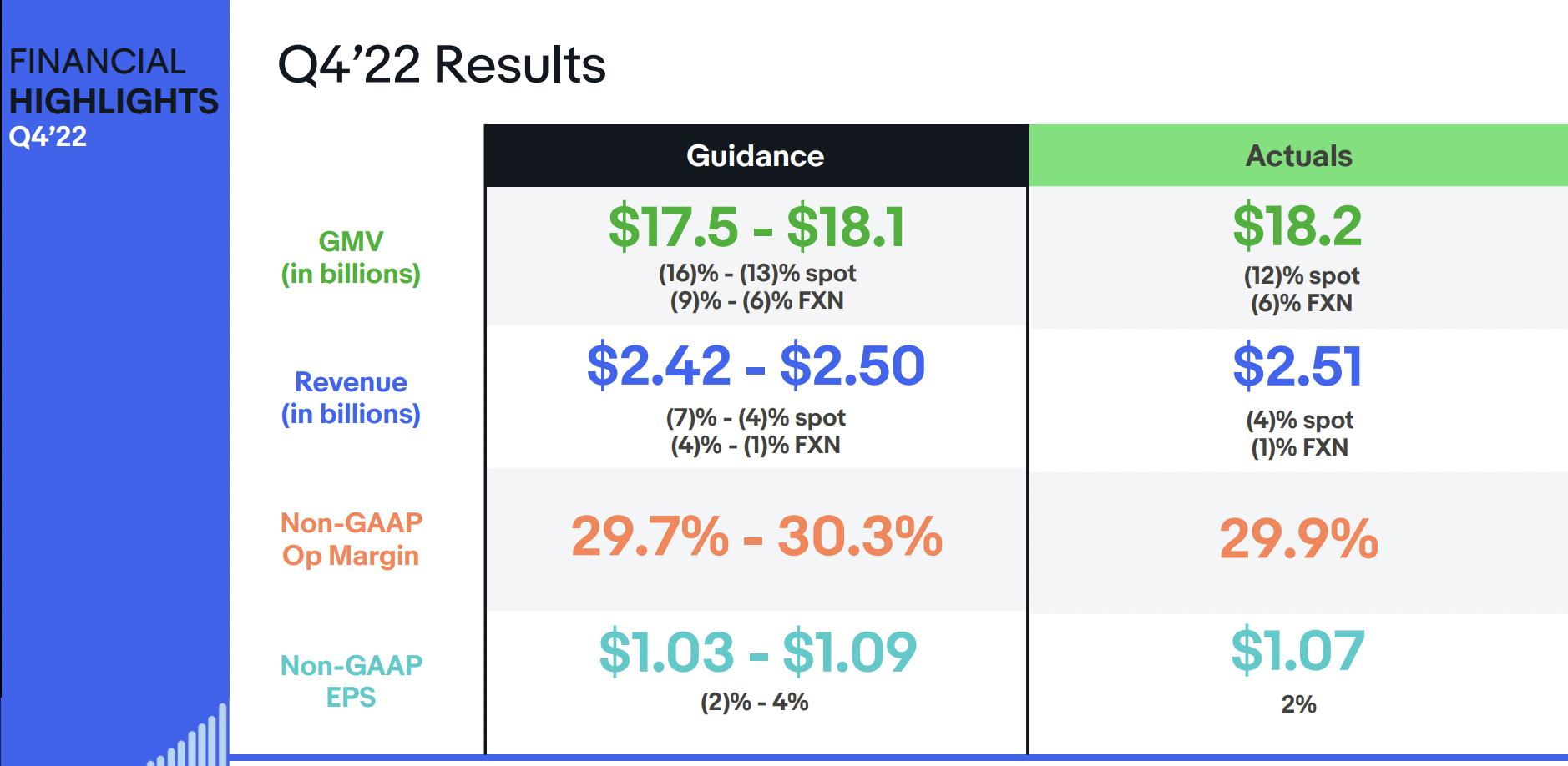

Positives from the last earnings report Q4FY22:

GAAP net income from continuing operations was $671 million, or $1.23 per diluted share, ( 22.5%) primarily driven by the change in the fair value of our equity investments.

Non-GAAP net income from continuing operations was $581 million, or $1.07 per diluted share (29.9%)

Generated $686 million of operating cash flow and $533 million of free cash flow from continuing operations.

Returned over $419 million to shareholders, including $300 million of share repurchases and $119 million paid in cash dividends.

Issued $1.15 billion of senior unsecured notes in November 2022.

eBay's first party advertising products, primarily driven by Promoted Listings, delivered $276 million of revenue in the fourth quarter, up 19% on an as-reported basis and up 27% on an FX-Neutral basis.

The company's total advertising offerings generated over $319 million in revenue in the fourth quarter, representing roughly 1.8% of GMV

Refurbished goods contributed positively to grow in Q4, as they continue to expand to new brands and categories. They also made the onboarding process for third-party sellers more scalable to increase the breadth and depth of refurbished selection on our marketplace

Within their luxury and trading cards categories, they continue to see healthy trends in authenticated item transactions in Q4, which has mitigated the macro driven ASP pressure observed across these industries in recent months.

Total ad revenue grew 19% during the quarter, driven by optimization and performance improvements in their standard promoted listings product.

Challenges from the last earnings report Q4FY22:

Revenue was $2.5 billion, down 4% on an as-reported basis and down 1% on a foreign exchange (FX) neutral basis.

Gross Merchandise Volume (GMV) was $18.2 billion, down 12% on an as-reported basis and down 6% on an FXNeutral basis.

US GMV declined 9% year-over-year decelerating by roughly two points versus the prior quarter.

International GMV declined 4% on an FX-neutral basis, which was stable sequentially

Active buyers were down roughly $1 million sequentially as a gradual improvement in buyer reactivation over the past few quarters has led to modest stabilization in their active buyer counts.

Highlights in FY22:

Generated $2.6 billion of operating cash flow and $2.2 billion of free cash flow from continuing operations.

Sold shares in Adevinta, Adyen and KakaoBank for cash proceeds of $1.1 billion in aggregate.

Returned over $3.6 billion to shareholders, including $3.1 billion of share repurchases and $489 million paid in cash dividends.

Challenges in FY22:

Net revenues decreased 6% to $9.8 billion primarily due to a decline in traffic resulting from the normalization of consumer behavior during 2022 compared to the elevated traffic experienced on our Marketplace platforms from the impact of COVID-19 during 2021

Net revenues were also impacted by reduced traffic in most markets resulting from geopolitical and inflationary pressure during 2022 compared to 2021.

In addition, net revenues were impacted by a stronger U.S. dollar in 2022 as FX-Neutral net revenues decreased only 4% compared to 2021.

The operating margin decreased to 24.0% in 2022 compared to 28.1% in 2021.

They generated cash flow from continuing operating activities of $2.6 billion in 2022 compared to $3.1 billion in 2021, ending the year with cash, cash equivalents, and non-equity investments of $5.9 billion