The Coca-Cola Company

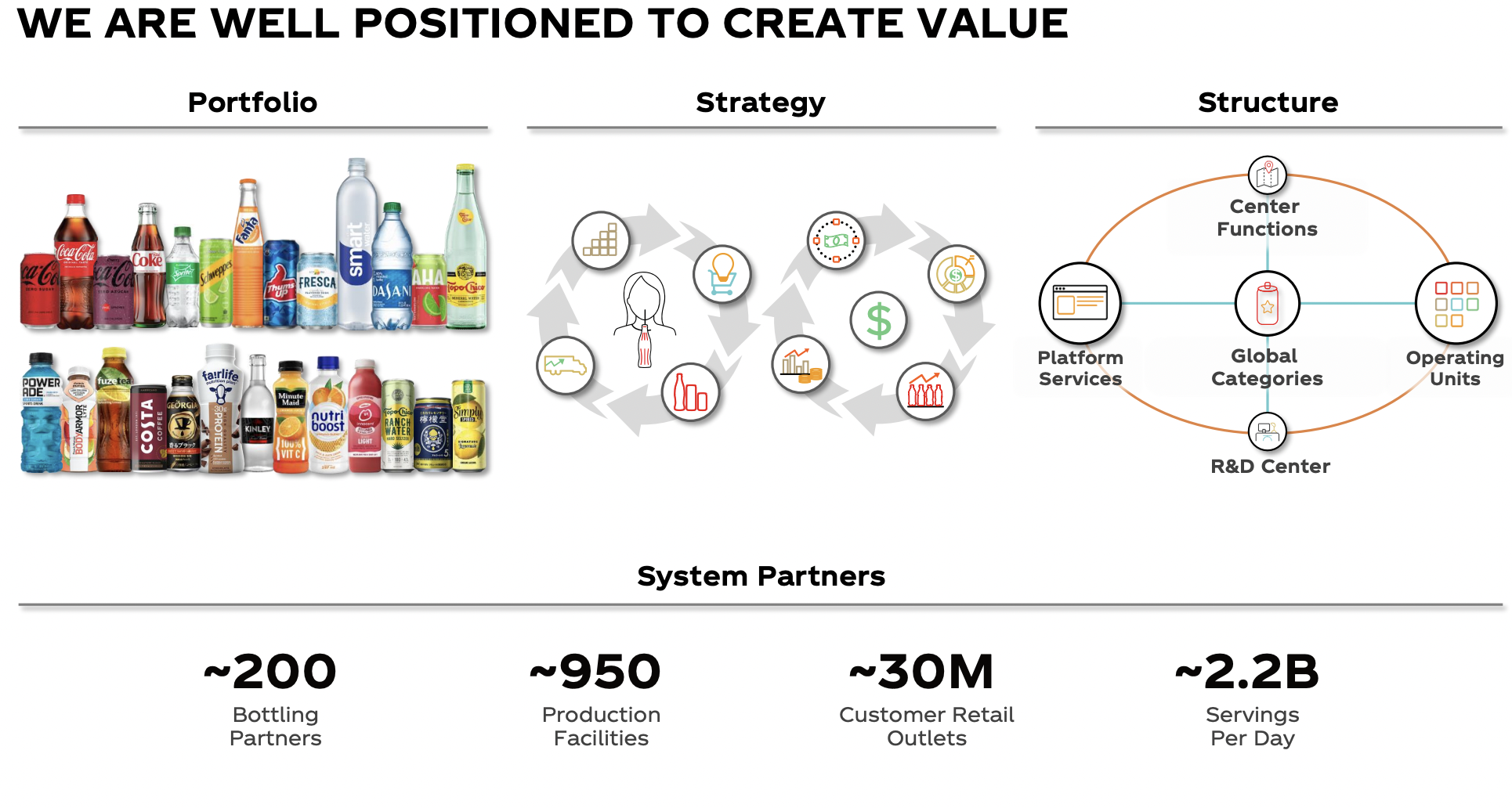

The Coca-Cola Company is a total beverage company with products sold in more than 200 countries and territories.

Best known as the producer of Coca-Cola it also manufactures sells, and markets other non-alcoholic beverage concentrates and syrups, and alcoholic beverages.

More than 1.9 billion servings of their drinks are enjoyed each day.

Employees: 700,000 +

Revenue: $43.004bn for FY2022

HQ Location: Atlanta, Georgia, U.S.

What they do:

Production and Distribution

The Coca-Cola System

They manufacture, market, and sell certain beverage concentrates, syrups, and finished beverages to authorized bottling partners.

Depending on the product, their bottling partners combine the concentrates with sweeteners, still water, and/or sparkling water, to prepare, package, sell, and distribute finished beverages.

Over 225 bottling partners across 900 bottling plants make up the Coca-Cola system and help to deliver their refreshments globally.

They have a beverage portfolio that has expanded to more than 200 brands and thousands of beverages around the world. These include Coca-Cola, Sprite, Fanta, and other sparkling soft drinks.

Their hydration, sports, coffee, and tea brands include Dasani, SmartWater, Vitaminwater, Topo Chico, Powerade, Costa, Georgia, Gold Peak, Ayataka, and BodyArmor.

Their nutrition, juice, dairy, and plant-based beverage brands include Minute Maid, Simply, innocent, Del Valle, fairlife, and AdeS.

Their Concentrate Operations manufacture, market, and sell beverage concentrates, sometimes referred to as "beverage bases," and syrups, including fountain syrups.

Their Finished product operations manufacture, market, and sell finished sparkling soft drinks and other nonalcoholic beverages.

Their Bottling Partners and some Company-owned operations manufacture, package, merchandise, and distribute the finished branded beverages to their customers and vending partners, who then sell their beverages to consumers.

Their vision and priorities:

They are guided by their purpose, which is to refresh the world and make a difference. Their vision for growth has three connected pillars:

•Loved Brands. They craft meaningful brands and a choice of drinks that people love and enjoy and that refresh them in body and spirit.

•Done Sustainably. They grow their business in ways that achieve positive change in the world and build a more sustainable future for our planet.

•For A Better Shared Future. They invest to improve people’s lives, from their employees to all those who touch their business system, to their investors, to the broad communities they call home.

Financial and Business Goals

Pursuing excellence globally and winning locally through relentless consumer-centricity

Investing in the long-term health of the business and raising the bar across all elements of their strategic flywheel

Generating US-dollar EPS growth to deliver value for our shareholders.

They have set a new industry-leading goal of 25% of their volume globally will be reduced for refillable or reusable packaging by 2030.

Outlook 2023

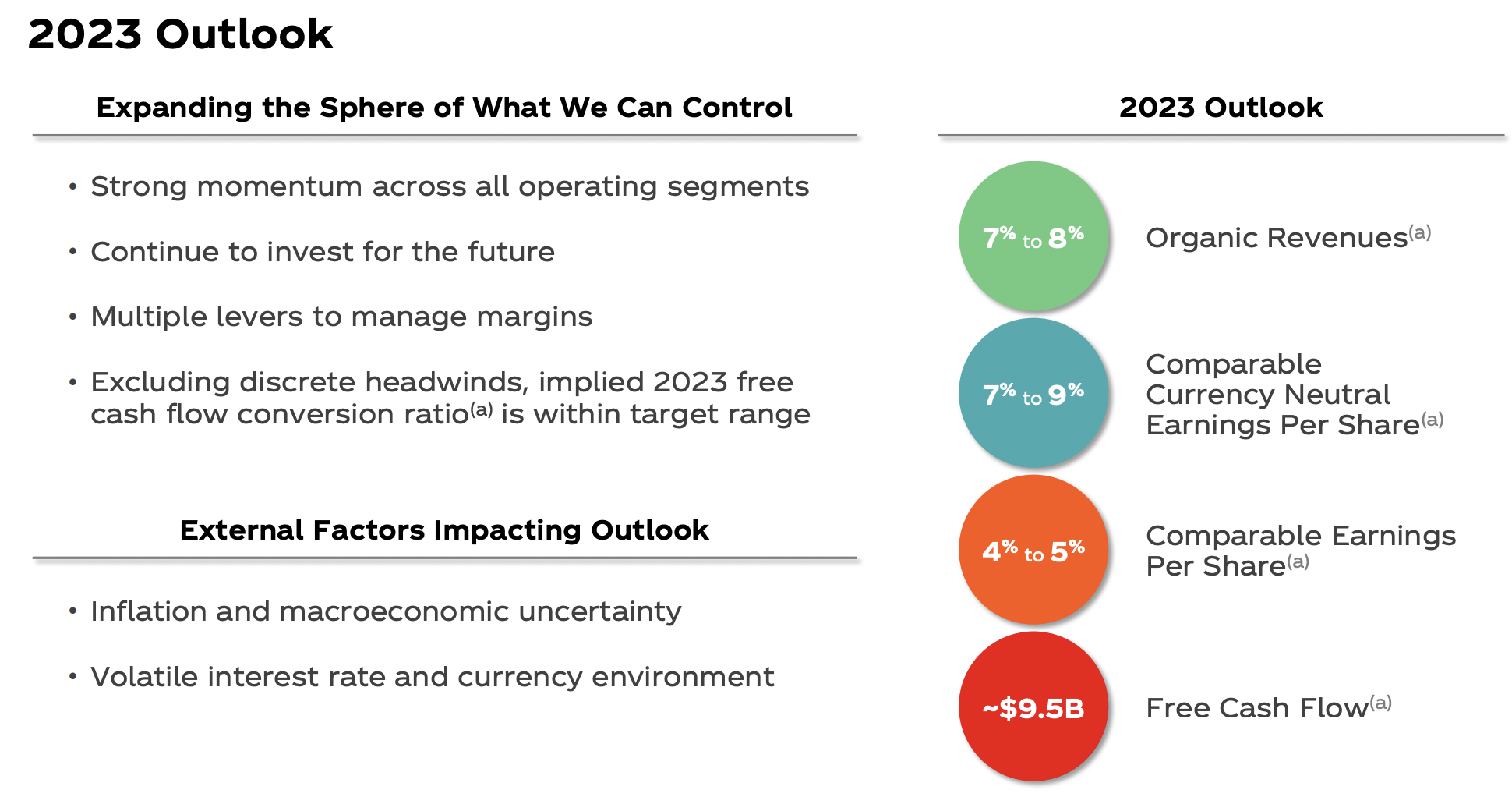

They expect organic revenue growth of 7% to 8%, primarily led by price mix amidst the ongoing inflationary environment

They expect comparable currency-neutral earnings per share growth of 7% to 9%

They expect per-case commodity price inflation in the range of a mid-single-digit impact on comparable costs of goods sold in 2023.

They expect their underlying effective tax rate to be 19.5% for 2023.

They expect comparable earnings per share growth of 4% to 5% versus $2.48 in 2022.

They expect to generate approximately $9.5 billion of free cash flow in 2023 through approximately $11.4 billion in cash from operations, less approximately $1.9 billion in capital investments.

Things to know right now

Company Leadership Changes

The company continues to focus on having the right leaders and organizational structure to deliver on its growth strategy, while also developing talent for the future.

John Murphy has begun an expanded role as President and Chief Financial Officer, and added oversight of Global Ventures, Bottling Investments, Platform Services, customer and commercial leadership, and online-to-offline digital transformation.

The company also named Henrique Braun to the newly created role of President, International Development to oversee seven of the company’s nine operating units. Braun will partner with Nikos Koumettis, President of the Europe operating unit, and Jennifer Mann, President of the North America operating unit, on global operational strategy in order to scale best practices and help ensure the company captures growth opportunities across all of its markets.

Leveraging Digital Engagement

In order to connect with more consumers they are linking consumption occasions with consumer passion points, the company is building deeper connections with consumers and reaching them in new and unique ways.

The company successfully executed on the Coca-Cola® “Believing is Magic” global campaign for FIFA World Cup Qatar 2022 by creating end-to-end, digitally driven experiences. The company developed its own digital platform, the Coca-Cola Fan Zone, which was activated in 41 markets and featured social experiences for soccer fans.

Approximately 5 million consumers interacted with this platform. Through an exclusive partnership with Panini, the officially licensed sticker album of FIFA World Cup Qatar 2022, soccer fans were able to trade physical and digital stickers, which drove approximately 28 million product label scans, up approximately 400% versus the 2018 FIFA World Cup.

Packaging Goals

The company continues to collaborate with partners to address challenges and create a circular economy for packaging.

In India, the company partnered with the grocery delivery service Zepto for a “return and recycle” initiative for PET bottles. Consumers can access the 2 “Return PET Bottles” feature on the Zepto app, where they can opt to return four empty PET bottles, to be collected by Zepto riders.

This initiative establishes an organized process of PET bottle collection with full traceability to help ensure effective plastic waste management.

In Latin America, the company partnered with the food aggregator Rappi to collect empty PET bottles.

In the Philippines, the company is transitioning the existing PET packaging of some of its brands to 100% recycled PET, excluding caps and labels, utilizing new sources of recycled PET from the joint venture investment PETValue, the first bottle-to-bottle recycling facility in the country.

The new packaging formats for Coca-Cola® Original Taste and Wilkins® Pure will expand the company’s lineup in recycled plastic packaging in the country.

The company also has approximately 50% of its portfolio in the country in returnable glass bottles.

Company Refranchising

The company completed the refranchising of company-owned bottling operations in Cambodia to Swire Coca-Cola Limited, a subsidiary of Swire Pacific Limited, and completed the sale of its stake in the bottler in Egypt to Coca-Cola HBC AG.

The company also announced the refranchising of company-owned bottling operations in Vietnam, which was completed in January 2023, and the company agreed to sell its stake in the bottler in Pakistan.

Sustainability News

They drove the growth of their low- and no-calorie beverages and continued to provide smaller package choices to enable consumers to manage sugar intake.

Approximately two-thirds of the products in their portfolio have less than 100 calories per 12-ounce serving.

Operating Business Segments:

Europe, Middle East & Africa

This segment includes ~130 markets and touches approximately 2.0 billion consumers and holds an industry retail value of approximately $254 billion.

Latin America

With approximately 520 million consumers, this segment is comprised of 39 markets and has an industry retail value of approximately $72 billion.

North America

Their flagship market reaches approximately 320 million consumers and holds an industry retail value of approximately $228 billion.

Asia Pacific

This segment reaches approximately 3.3 billion consumers across 37 markets and holds approximately $308 billion in industry retail value.

Global Ventures (GV)

This segment focuses on globally scaling acquisitions and brands, such as Costa Limited and Coca-Cola’s investment in Monster Beverage Corp, as well as identifying and nurturing future opportunities for growth

Bottling Investments Group (BIG)

BIG was created to ensure bottling operations receive the appropriate investments and expertise to ensure their long‑term success within the company.

Their Competitors

PepsiCo, Inc.

Nestlé S.A.

Keurig Dr Pepper Inc.

Groupe Danone

The Kraft Heinz Company

Suntory Beverage & Food Limited

Unilever.

Their financial calendar

Q1: January-March- Earnings 1st April 2023

Q2: April -June - Earnings 1st July 2023

Q3: July-September - Earnings 30th October 2023

Q4: October-December - Earnings 14th February 2024

Next Earnings Report:

Around 1st April 2023

Positives from the last earnings report Q4FY22:

They delivered 15% organic revenue growth in the quarter with strong growth across operating segments. This was driven by pricing actions across markets and revenue growth management initiatives to retain and add consumers.

Concentrate sales were 3 points ahead of unit cases for the quarter primarily driven by one additional day and the timing of concentrate shipments.

Price/mix grew 12% for the quarter

Per Operating Segment:

Europe, Middle East and Africa

Price/mix grew 15% for the quarter, driven by pricing actions across operating units along with inflationary pricing in Turkey. For the quarter, concentrate sales were 1 point behind unit case volume, largely due to the timing of concentrate shipments.

North America

Unit case volume was even during the quarter, as growth in sparkling soft drinks, juice drinks and value-added dairy beverages was offset by declines in other beverage categories.

Price/mix grew 12% for the quarter, primarily driven by pricing actions in the marketplace and the continued recovery in the fountain business.

Operating income grew 6% for the quarter, which included items impacting comparability.

Comparable currency neutral operating income (non-GAAP) grew 12% for the quarter, driven by strong organic revenue (non-GAAP) growth, partially offset by higher operating costs and an increase in marketing investments versus the prior year.

Latin America

Price/mix grew 26% for the quarter, driven by pricing actions in the marketplace and favorable channel and package mix, in addition to inflationary pricing in Argentina.

For the quarter, concentrate sales were 4 points ahead of unit case volume, primarily due to one additional day along with cycling the timing of concentrate shipments in the prior year.

Unit case volume grew 2% for the quarter, with solid growth across most categories. Growth was led by Brazil and Mexico.

Operating income grew 22% for the quarter, which included a 12-point currency headwind and items impacting comparability.

Comparable currency-neutral operating income (non-GAAP) grew 34% for the quarter, primarily driven by strong organic revenue (non-GAAP) growth, partially offset by higher operating costs and an increase in marketing investments versus the prior year.

Asia Pacific

Price/mix grew 7% for the quarter, primarily driven by pricing actions in the marketplace, partially offset by negative geographic mix.

For the quarter, concentrate sales were 9 points ahead of unit case volume, primarily due to the timing of concentrate shipments.

Operating income grew 6% for the quarter, which included items impacting comparability and a 15-point currency headwind.

Comparable currency neutral operating income (non-GAAP) grew 22% for the quarter, primarily driven by organic revenue (non-GAAP) growth across all operating units, partially offset by higher operating costs.

Global Ventures

Organic revenues increased. Revenue performance benefited from cycling the impact of pandemic-related Costa retail store closures in the United Kingdom in the prior year

Bottling Investments

Unit case volume grew 1% for the quarter, driven by strength in India and Vietnam.

Price/mix grew 14% for the quarter, driven by pricing actions across most markets.

Challenges from the last earnings report Q4FY22:

The environment remained dynamic as inflation, geopolitical tensions, pandemic-related mobility restrictions, and currency volatility persisted

Unit cases declined 1% as broad-based growth across most markets and investments in the marketplace were more than offset by the suspension of business in Russia and a decline in China.

Comparable gross margin for the quarter was down approximately 90 basis points versus the prior year, mainly driven by currency headwinds in the volatile macro backdrop and the mechanical effect of consolidating the BODYARMOR finished goods business.

Per Operating Segment:

Europe, Middle East and Africa

Unit case volume declined 5% for the quarter, as strong growth in Western Europe was more than offset by the suspension of business in Russia.

For the quarter, operating income declined 18%, which included items impacting comparability and a 27-point currency headwind.

Comparable currency neutral operating income (non-GAAP) declined 5% for the quarter, as strong organic revenue (non-GAAP) growth across most operating units was more than offset by higher operating costs and an increase in marketing investments versus the prior year.

North America

Unit case volume was even during the quarter, as growth in sparkling soft drinks, juice drinks and value-added dairy beverages was offset by declines in other beverage categories.

Price/mix grew 26% for the quarter, driven by pricing actions in the marketplace and favorable channel and package mix, in addition to inflationary pricing in Argentina.

For the quarter, concentrate sales were 4 points ahead of unit case volume, primarily due to one additional day along with cycling the timing of concentrate shipments in the prior year

Operating income grew 22% for the quarter, primarily driven by strong organic revenue (non-GAAP) growth.

Asia Pacific

Unit case volume declined 1% for the quarter, driven by strong growth in India and Vietnam, which was more than offset by a decline in China due to varying levels of pandemic-related mobility restrictions.

Global Ventures

Net revenues declined by 5%. Revenue performance benefited from cycling the impact of pandemic-related Costa retail store closures in the United Kingdom in the prior year.

Operating income and comparable currency neutral operating income (non-GAAP) both declined for the quarter, as solid organic revenue (non-GAAP) growth was more than offset by higher operating costs.

Bottling Investments

Operating income declined 15% for the quarter, which included items impacting comparability and a 9-point currency headwind.

Comparable currency neutral operating income (non-GAAP) declined 18% for the quarter, as strong organic revenue (non-GAAP) growth was more than offset by higher operating costs.

Highlights in FY22:

Overall, throughout 2022, they have maintained consistent volume growth relative to 2019.

Unit case volume grew 5% as broad-based growth across all operating segments was driven by strength in away-from-home channels and ongoing investments in the marketplace.

Price/mix grew 11% for the year

Per Operating Segment:

Europe, Middle East and Africa

For the year, the company gained value share in total NARTD beverages, led by share gains in France, Spain and Poland.

North America

The company gained value share in total NARTD beverages for the year, driven by the continued recovery in away-from-home channels along with strong performance in at-home channels for sparkling soft drinks and value-added dairy beverages.

Asia Pacific

For the year, the company gained value share in total NARTD beverages, led by share gains in India, Australia, Japan and South Korea.

Challenges in FY22:

For the year, they delivered a free cash flow of $9.5 billion, a decline of 15% versus the prior year. Much of the decline versus their expectations occurred due to the deliberate buildup of inventory in the face of a volatile commodity environment and higher-than-anticipated tax payments.

Cash flow was impacted by cycling working capital benefits from the prior year and higher incentive payments in 2022.

Per Operating Segment:

Latin America

For the year, the company lost value share in total NARTD beverages, as share gains in Brazil and Argentina were more than offset by pressure in sparkling soft drinks in Mexico.