Citigroup

Citigroup (Citi) is a global diversified financial services holding company, whose businesses provide consumers, corporations, governments and institutions with a range of financial products and services.

They provide consumer banking and credit, corporate and investment banking, securities brokerage, trade and securities services and wealth management.

Citi has approximately 200 million customer accounts and does business in more than 160 countries and jurisdictions.

Employees: 223,400

Revenue: $71.9B for FY2021

HQ Location: New York City, United States

What they do:

Citigroup has two operating segments - Institutional Clients Group (focused on selling to companies) and Personal Banking & Wealth Management (focused on individuals)

Their service are split into

Banking - commercial banking and advisory

Markets - trading in equities and fixed income products

Services - Treasury and Trade Solutions, and Securities Services

US Personal Banking

Wealth Management

As part of a strategic refresh (see below) the company will focus its consumer banking in Asia and EMEA on four wealth centers: Singapore, Hong Kong, the UAE and London.

As a result the company is existing from the remaining 13 markets across these two regions.

Their Vision:

“Our vision is for Citi to be the preeminent banking partner for institutions with cross-border needs, a global leader in wealth management and a valued personal bank in our home market of the United States.”

How we are getting it done:

Thinking global

Simplifying our bank

Increasing connectivity

Investing in our team

Financial and Business Goals

Stronger synergies between different business sectors

Improved Business Mix (accelerated growth in Services and Wealth, targeted market share gains in banking, and markets)

Lean into Citi’s global network

Things to know right now

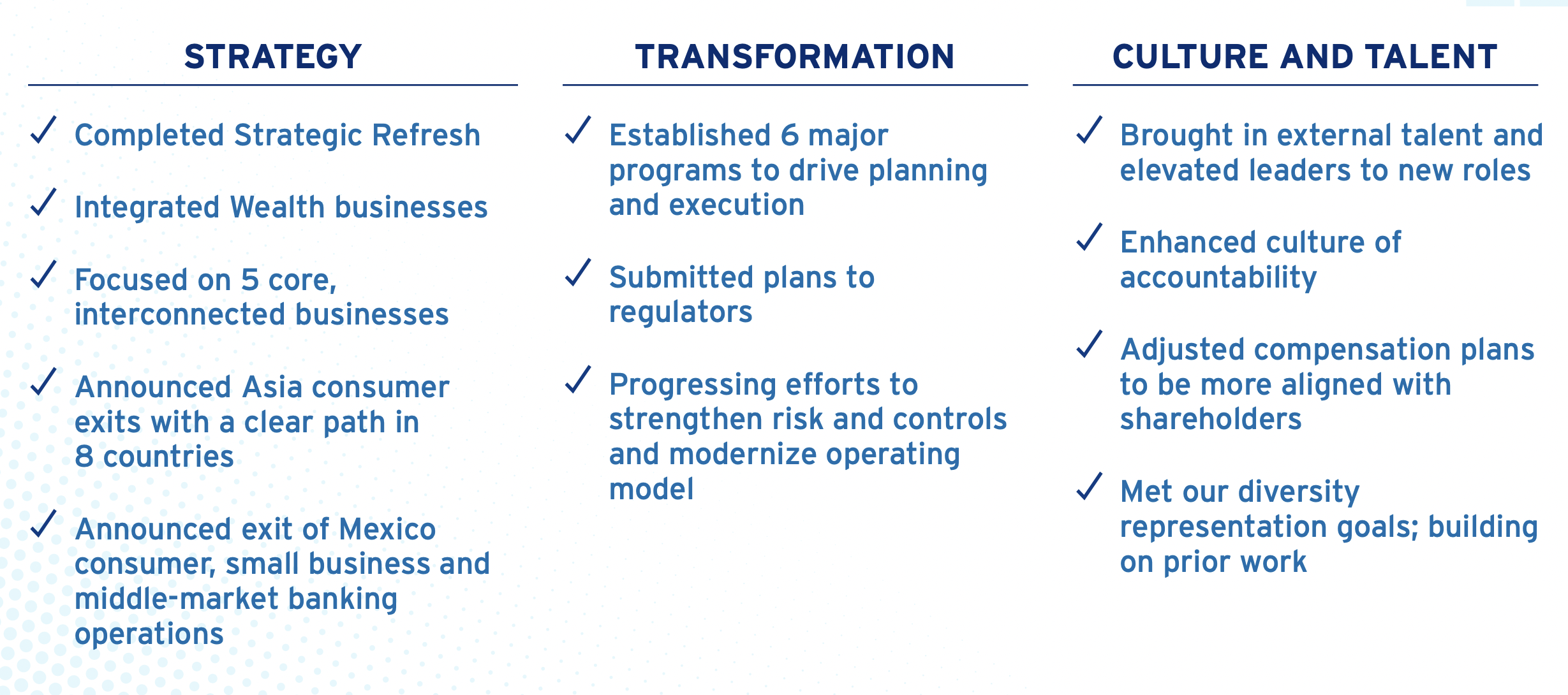

Strategic Refresh

In the first quarter of 2022 Citi changed the way it reports to align with its vision and strategy

Progress achieved in Year 1 of Strategic Refresh

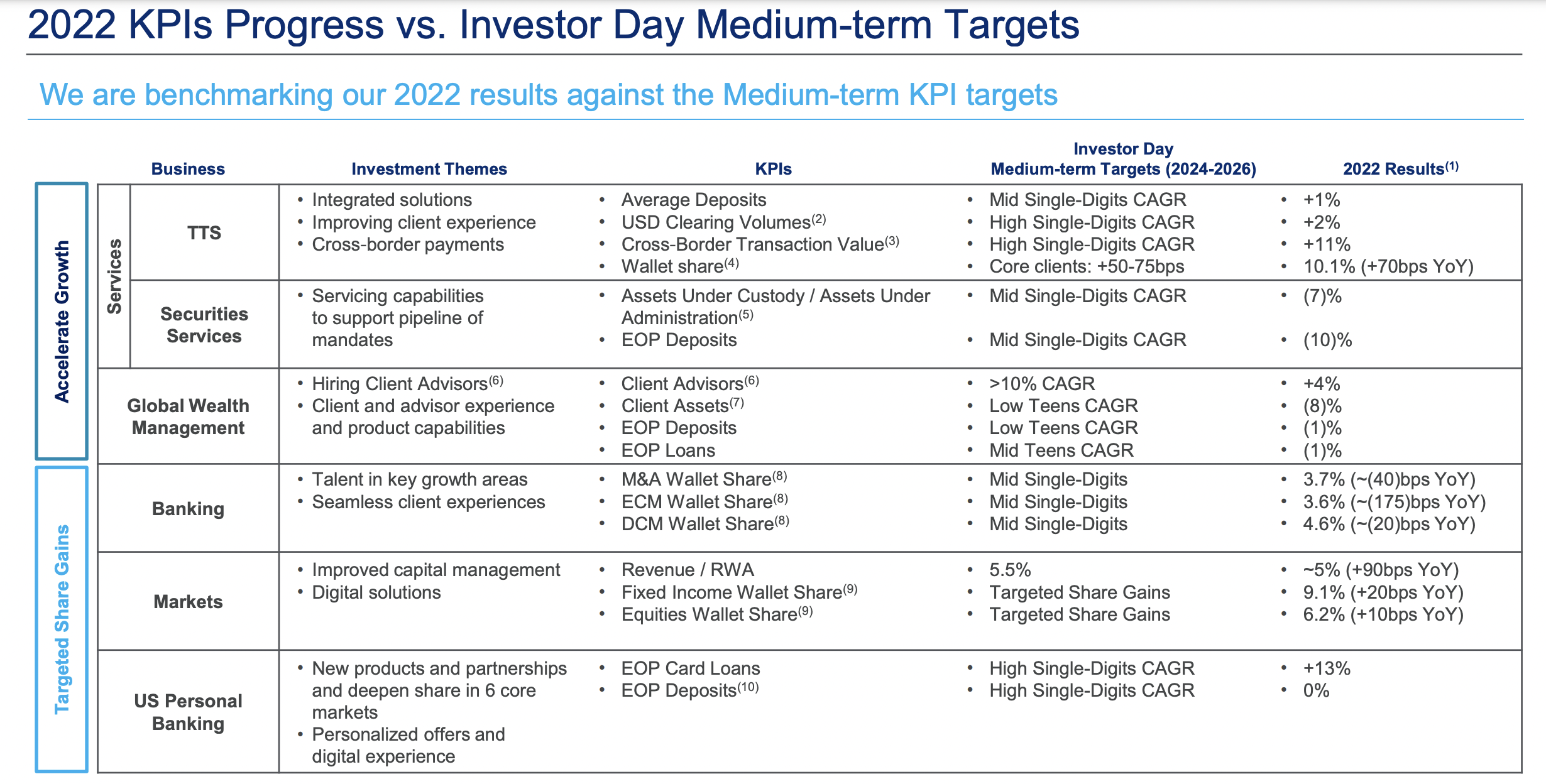

Metrics to benchmark their progress:

Business Segments:

Institutional Clients Group (ICG)

ICG provides corporate, institutional and public sector clients around the world with a full range of wholesale banking products and services, including fixed income and equity sales and trading, foreign exchange, prime brokerage, derivative services, research, corporate lending, investment banking, cash management, trade finance and securities services.

Revenue is mainly generated from fees and spreads (the difference between a buy and sell price) associated with these activities.

ICG’s international presence is supported by trading floors in approximately 80 countries and a proprietary network in 95 countries and jurisdictions. At December 31, 2021, ICG had $1.8 trillion in assets and $950 billion in deposits.

In FY 2021 ICG recorded $43.8 billion in revenues

Personal Banking and Wealth Management

PBWM consists of consumer banking businesses in North America. PBWM provides traditional banking services to retail customers through retail banking, branded cards, and retail services.

The segment also includes Global Wealth Management, including the Private Bank and Wealth Management divisions.

Their Competitors

UBS group

PNC Financial Services

Wells Fargo

Bank of America

JP Morgan Chase

Goldman Sachs

Their financial calendar

Q1: January-March Earnings 14th April 2022

Q2: April-June - Earnings 15th July 2022

Q3: July-September - Earnings 14th October 2022

Q4: October-December - Around 13th January 2023

Next Earnings Report:

Around 14th April 2023

Positives from the last earnings report:

4th Quarter revenues $18bn with earnings per share of $1.16

Strong client engagement across ICG

Treasury and Trade Solutions (TTS) revenues up 32% year on year

Returned $7.3bn to shareholders in dividends and share repurchases

Challenges from the last earnings report:

Wealth revenues down 2% year on year